Archives of “Gold / Silver” category

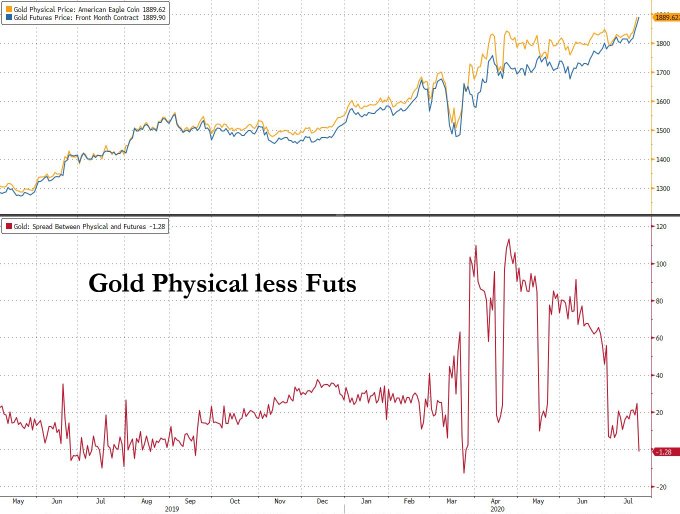

rssGold spread turns negative. Last time this happened was at the March 23 crash low

Silver continues its surge and tests November 2013 highs

Moved above the $23 level for the 1st time since 2013.

The price of silver is trading up around $1.16 or 5.42% at $22.46. That is off the days high of $23.02. At the high the price was testing the November 1, 2013 high price of $23.08 (see weekly chart below). Since the week of June 19. The price of silver has moved from a low of $16.95 to the high today of $23.08. That equates to a 35.8% gain. For the year the price has moved up from the closing level of $17.85. The year to date gain. The gain to the high today is equal to 29.2%.

Drilling to the hourly chart, the last 4 days has seen the price move up 21.7% from the low to high with the last 2 days really extending quickly to the upside. However with the high price testing that 2013 swing high, there may be some rotation back to the downside as traders ring the cash register.

He’s back. This time in Au and Ag.

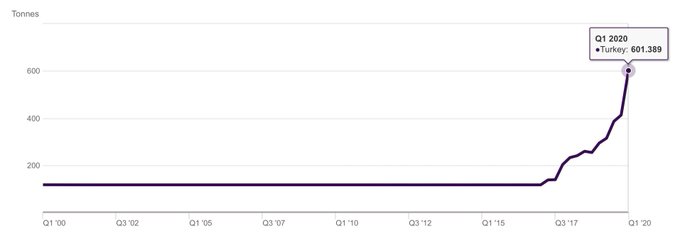

Turkey Gold Reserves

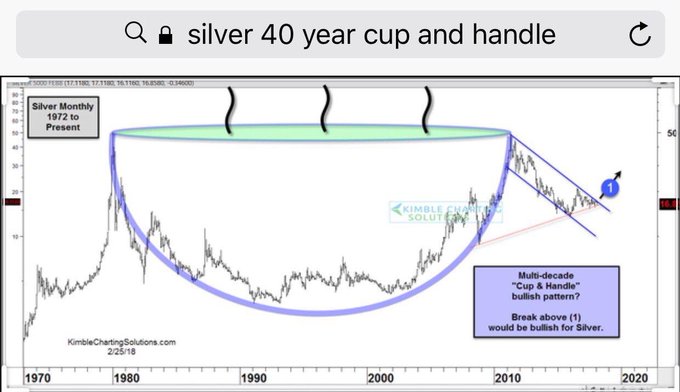

Silver offers a bargain

Silver vs gold

The precious metals silver and gold continue to have a strong fundamental bias. Low interest rates, extra stimulus expected, and risk positive markets on vaccine hopes are all keeping gold and silver supported.

Silver has more obvious upside than gold

If you look at silver you can see that the current price is less than half of what the record high has been (at around $50). This means that silver has plenty of more room to go higher. Goldman Sachs see’s a ‘near perfect environment for silver’ and Citi is ‘very positive’ noting the steady investment demand.

Silver benefits from both safe haven bids and its demand as an industrial metal being used for mobile phones and solar panels. Furthermore, Bloomberg notes that inflows in silver backed ETF’s are now running at well over 1000 tons a month

Where will buyers re-enter?

Firstly, look at the 4 hour chart and the breakout of the ascending weekly trend line. Any return to $19.20 should find buyers.

Secondly look for a Monthly close above the trend line marked. Some longer term buyers will enter at market or a slight pullback to $19.20 if we get a close above $19.20 at the end of the month. Definitely one area to watch. I took profit at 20.30 yesterday on my longs from the same trend line break and I am looking at potential re-entry levels.

*Sips tea* #silver $silver ———-This was one more reason why we are Highly Bullish on Silver

$Silver: “You ain’t seen nothin’ yet”

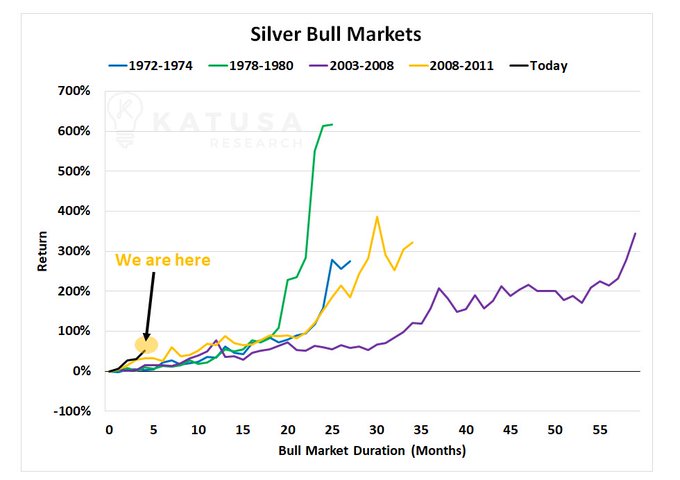

Silver on the move in break to fresh highs since 2016

The market may be largely focusing on gold, but silver is also a star performer in the commodities space

Price triggered some stops in a quick move above $20 earlier, racing to a high of $20.43 before backing off slightly to $20.24 now. That sees silver trade to its highest levels since August 2016, as the commodity continues to soar after bottoming out in late March.

If buyers can maintain the current showing, it would mark 11 weeks of gains in the past 12 weeks for silver – its strongest winning momentum since the parabolic move in 2011.

Much like how gold is aiming to break its 2011 highs, silver is also currently aiming to break its 2016 highs and the overall outlook is still considerably optimistic – similar to gold.

Another thing to note about silver is that plenty of investors are starting to give it more attention and focus as the gold trade becomes more and more crowded, and upside momentum in gold prices may stall as a result.

There’s a saying in the market that ‘silver always lags gold’ but if gold prices are looking poised to take a run further and investors are also starting to keep silver as an alternative, the conditions look ripe for silver to keep going as well in the long-term.

For now, just be mindful of the highs at around $20.50 to $20.78 as well as the 2016 high of $21.14 as those will be key resistance regions to watch on any further upside move.

Gold trades to the highest level since September 2011

Takes out the previous high for the year at $1818 .02

the price of gold is currently trading up $6 at $1816.43. The high price extended to $1820.53. That took the price above the high for the year from a few weeks back at $1818.02.

Breaking above that level took the price to the highest level since the week of September 23, 2011.

Gold has been supported by flight to safety flows. There is a lot of money out there and it seems if it’s not going into the US stocks, it’s heading into gold.

Gold closed the year at $1517.27. At $1816 that’s a gain of around 19.7%. That again is even better than the NASDAQ index which is currently up 18.79%, and far outpaces the gain from the S&P which is currently up just 0.17% on the year.