Archives of “Gold / Silver” category

rssCiti on gold , raise their targets

Comments from Citi on gold. lifting their short-term targets to ~$2,100/oz. 6-12m targets breaching $2,300/oz seems plausible.

In briefr:

- A lot of retail accounts seen liquidating at sub 2000, especially those that bought gold around the 2050 – 2100 level.

- However, deterioration of US-China relations had led money flow into safe havens. Gold price rebounded to above $1900 level.

- We lift gold short-term targets to ~$2,100/oz. 6-12m targets breaching $2,300/oz seems plausible. The record pace of ETF investor inflows, a weakening US$ and negative real yields are the primary drivers for the push higher.

- GoldUSD has been closer to home a break to a new highs would suggest an extended move initially towards $2,400 (the top of the upward trend line).

Crucial Update :GOLD ,SILVER ,PALLADIUM ,PLATINUM -Anirudh Sethi

To read more enter password and Unlock more engaging content

Silver and its byproduct source metals (ex gold). About 71% of silver mining supply comes as a byproduct from other metals.

Gold and silver continue to follow the dollar

Silver leading the charge with a 4% gain

Both gold and silver following the lower US dollar.The US dollar has continued its moved to the downside in trading today, and gold and silver are certainly reacting.

The price of gold traded to a another new all time high price of $2048.18. The current price is trading at $2046 up 1.32% or $26.25.

Meanwhile the price of silver is currently up over $1 or 4.02% at $27.05. It’s high price reached $27.12 so far today.

The estimated price of gold when Rome collapsed, or when authoritative money dies.

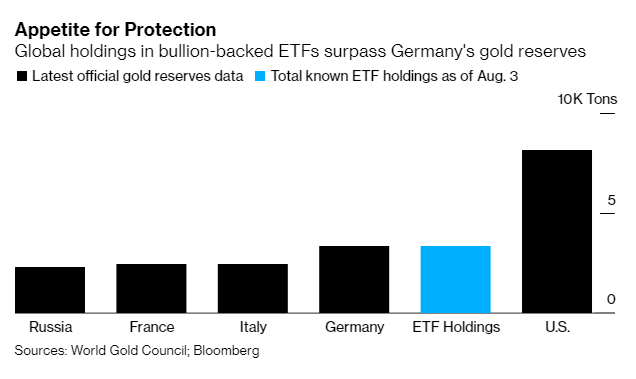

Only the US Government has more gold than ETFs.

Silver. The cheapest metal on earth.

Total gold ETF holdings

Everything should be measured in Gold… if doing that SPX peaker in 2018… and has falled ever since…