That used to be 28,000+ contracts a few months ago. Inventory is getting tight, delivery is consuming inventory.

Archives of “Gold / Silver” category

rssAn Update : #GOLD #SILVER #PALLADIUM #PLATINUM #COPPER #NICKEL #ZINC -#AnirudhSethi

To read more enter password and Unlock more engaging content

Gold silver ratio around 2016 lows favours gold over silver

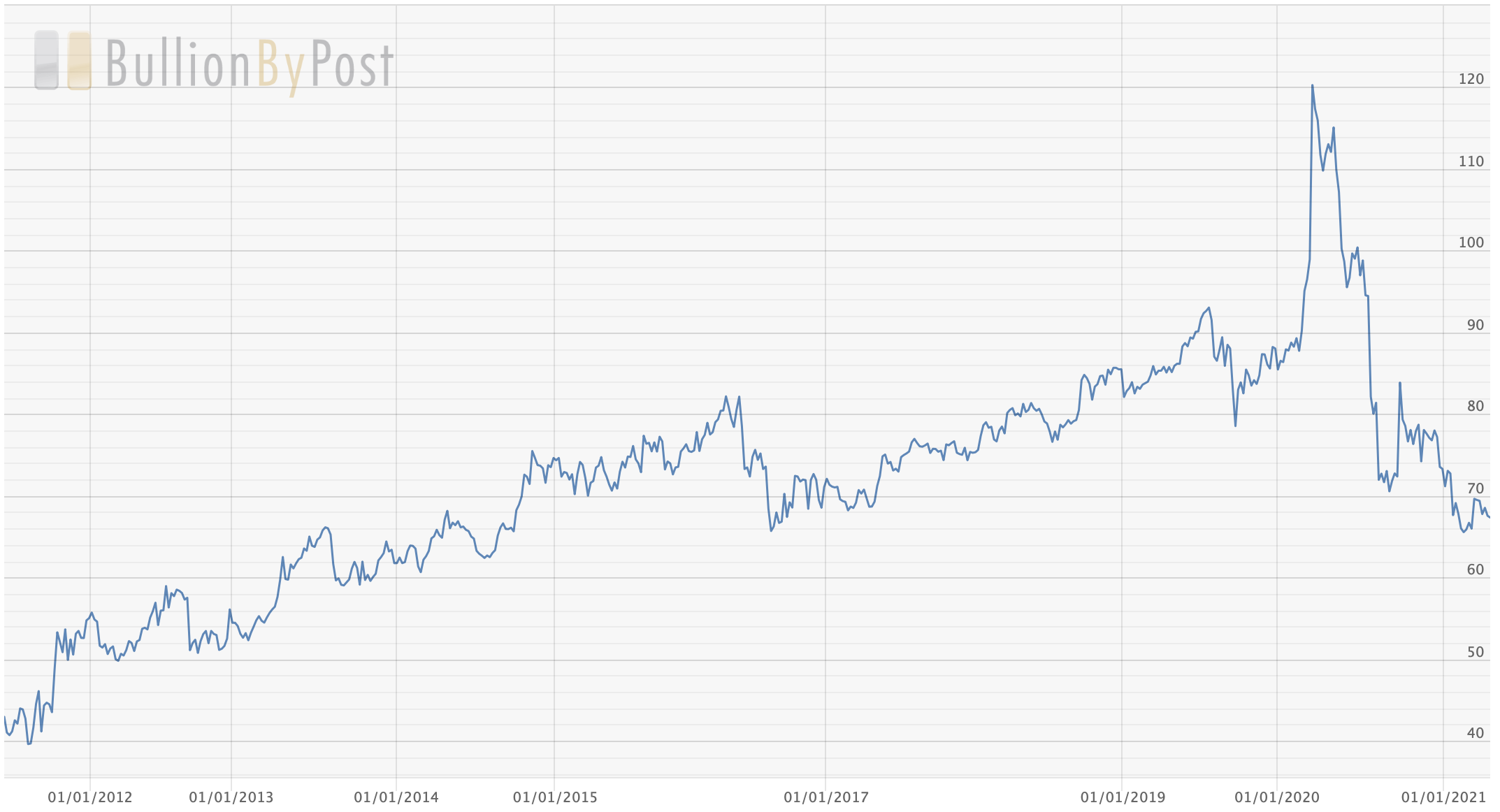

Gold silver ratio

The gold silver ratio is down near its 2016 lows.

What is it?

The gold to silver ratio represents the relative value of one ounce of silver to one ounce of gold. It is a weight for weight comparison. In basic terms the ratio shows you how many ounces of silver you would need in order to buy a single ounce of gold.

As an example let’s say gold is trading at $1000 per ounce and silver is trading at $10 per ounce. In this example you would need one hundred ounces of silver to buy a single ounce of gold. The gold silver ratio would be 100:1.

The ratio moves each day

Every day the ratio is changing as the price of gold and silver is changing. In order to calculate it you divide the price of gold by the price of silver. You can see now that when the gold/silver ratio is high it means that MORE silver is needed to buy one ounce of gold and silver is relatively cheap compared to gold. This was the case last year when the gold silver ratio was up well over 110.

Conversely, when the gold silver ratio is low it means that LESS silver is needed to buy one ounce of gold and silver is relatively expensive compared to gold.

How to use it

Some analysts, traders, and investors look to “trade the ratio”, buying silver when the gold/silver ratio is high and switching to gold when it falls. If inflation risks rise, and the Fed stays bearish, then precious metals offer good value. Looking at the gold/silver ratio can help you either a) choose between silver and gold or b) allocate your positions between silver and gold

An Update : GOLD ,SILVER ,Platinum ,Palladium -#AnirudhSethi

To read more enter password and Unlock more engaging content

An Update #GOLD #SILVER #Palladium #Platinum -#AnirudhSethi

To read more enter password and Unlock more engaging content

ICYMI – China’s Q1 gold consumption up 93.9% y/y

China Gold Association with the data published on Friday.

- China Q1 gold consumption up 93.9% y/y

- Output fell 9.92% y/y

- First quarter demand reverted to pre-pandemic level

Q1 2021 was a huge bounce back from the pandemic impacted Q1 of 2020, do bear that in mind when reading the above.

The data is via a Reuters report and there is a little more here at the link.

Gold is having a good session in Asia to open the week:

Central bank #gold holdings 👇 The trend is your friend. Isn’t the timing of the turning point telling?

An Update : GOLD ,SILVER ,PALLADIUM ,PLATINUM -#AnirudhSethi

To read more enter password and Unlock more engaging content

Crucial Update : Gold ,Silver ,Palladium ,Platinum – #AnirudhSethi

To read more enter password and Unlock more engaging content

ICYMI – Reports China has given banks permission to import large amounts of gold

This an ICYMI on reports that Chinese authorities have given domestic and international banks permission to import large amounts of gold into the country

Reuters cited 5 sources for the information

China is the world’s biggest gold consumer but saw a fall in imports during the pandemic as domestic demand switched to other more urgent needs. Economic rebound from H2 2020 kicked off imports again, fuelling a rise in the local premium – if the reports of increased imports are correct the local premium should diminish and the XAU price should benefit.