German Dax up 0.5%, France’s CAC -0.27%. UK FTSE, -0.7%

The European shares are ending the session with mixed results. Provisional closes are showing:

- German DAX, +0.5%

- France’s CAC, -0.27%

- UK’s FTSE, -0.7%

- Spain’s Ibex, -0.5%

- Italy’s FTSE MIB, -0.79%

- Portugal PSI 20, -0.31%

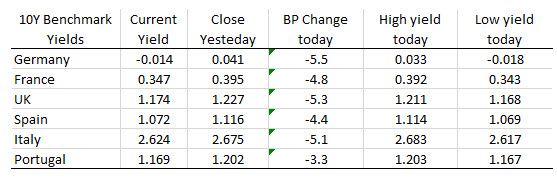

in the benchmark 10 year note sector fields were sharply lower with the German DAX down -5.5 basis points and closing back below the 0.0% level.