Pakistan – it better rally or it is night-night sooty

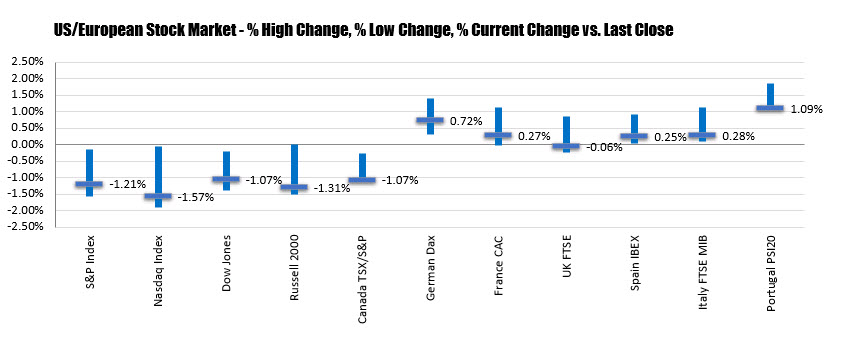

For the week, the numbers were not impressive:

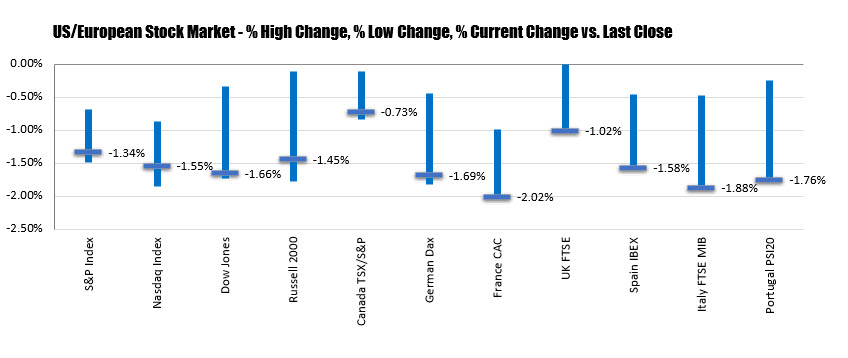

The Nikkei closes lower but bounced off its lows in the last hour of trading as Chinese stocks also recouped losses seen immediately after the lunch break earlier. At one stage, the Nikkei was down by nearly 1% as US increased tariffs on $200 billion worth of Chinese goods and as China vowed to retaliate.

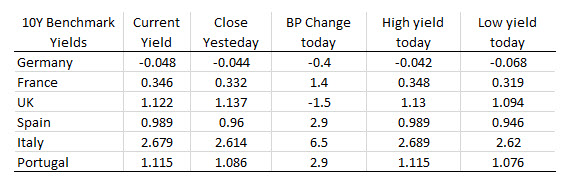

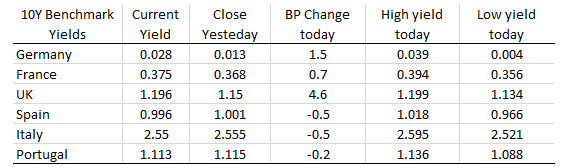

In the benchmark 10 year yields, yields are mostly higher on risk off concerns. The German 10 year is down marginally and the UK 10 year is also lower by -1.5 bps:

Here is a look at the DAX as the recovery continues:

Japanese stocks are seeing decent gains on the day despite a weaker close in Wall Street in trading overnight as investors are gearing towards the 10-day break after the end of this week. Other Asian equities are generally more subdued with the Shanghai Composite down by 1% and the Kospi down by 0.4% as global economic conditions remain questionable after South Korea Q1 GDP contracts, slowing to its weakest pace since the global financial crisis.