Tokyo’s main index closes lower, but near the highs for the day

As mentioned earlier, the losses seen in Asian stocks today belie actual market sentiment which is looking more optimistic. The negative tones in Asia is mostly a bit of a catch up play to overnight declines in Wall Street more than anything else, but the losses itself have been pared slightly since early morning trade.

US equity futures are up by 0.5% currently with Treasury yields also inching higher and that is helping to keep yen pairs underpinned, as USD/JPY trades at 109.65 currently.

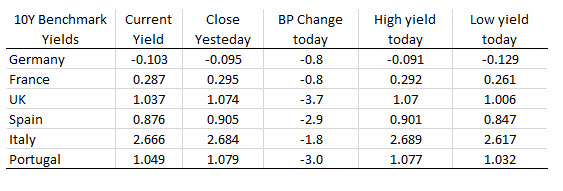

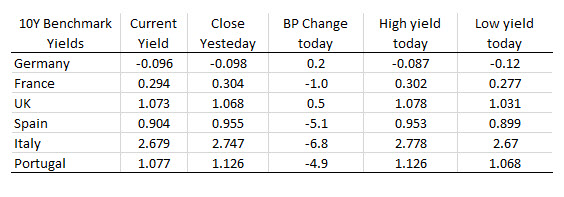

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: