Global Credit (Average of IG+HY+EM) & MSCI World Index (inverted scale)

This mainly reflects the softer mood in Wall Street overnight as well as US equity futures today, which are down by about 0.5% currently. US-China tensions are still the main factor affecting markets as it looks like the cautious sentiment will continue for a while longer.

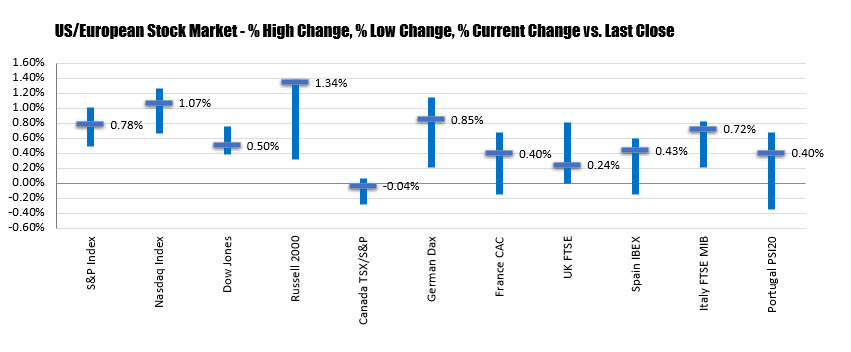

The European equity markets are closed with the shares ending the session mostly lower:

Japanese stocks had quite a bit to deal with in the session today with trade balance data suggesting that exports are showing a further slump but domestic demand is seen improving. However, US-China trade tensions are still seen lingering in the region and that didn’t really help with the mood in the final two hours of trading.