Bloomberg Commodity Index a break of 77.83 would signal acceleration to test record low ~72.50

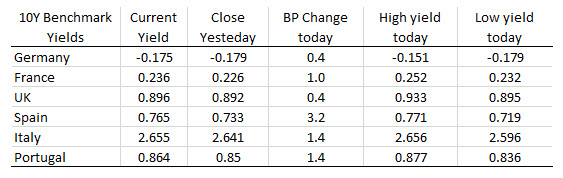

In the benchmark 10 year note sector, yields are higher on the day:

Asian stocks may be trading lower on the day but it’s more of a reflection of overnight trading in Europe and US because sentiment is faring slightly better in general today. US equity futures are trading up by 0.2% and European equity futures are also signaling slightly more positive tones at the open later.

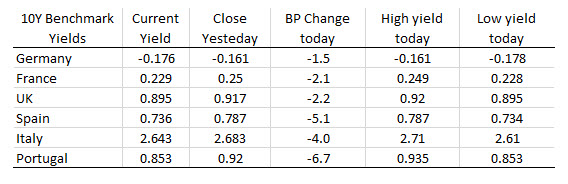

In other markets, as traders in London/Europe look toward the exits:

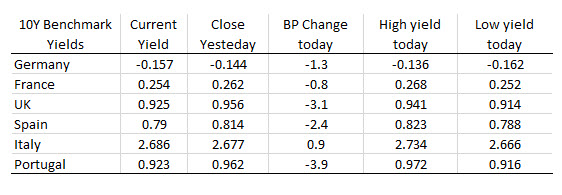

In other markets London/European traders look toward the exits, a snapshot shows

In other markets London/European traders look toward the exits, a snapshot shows

Equities continue to take a bit of a breather from US-China trade tensions as Japanese stocks inch higher after seeing European equities fare better in overnight trading. Chinese stocks are also performing better today but there’s a feeling that this is more of a relief rather than any risk-on mood amid lingering trade tensions.