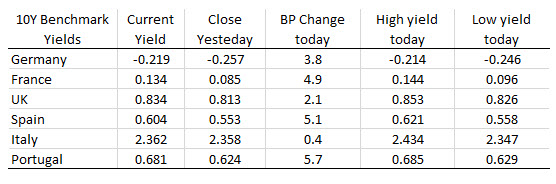

Yields are higher in Europe today

- German DAX, +0.77%

- France’s CAC, +0.34%

- UK’s FTSE, +0.6%

- Spain’s Ibex, 0.66%

- Italy’s FTSE MIB, +0.6%

The German 10 year yield is below the 2016 low at -0.189% still.

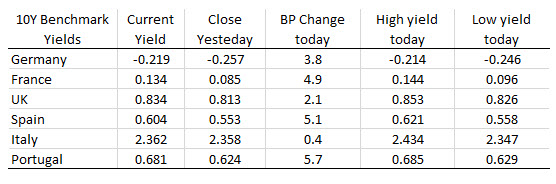

The German 10 year yield is below the 2016 low at -0.189% still.

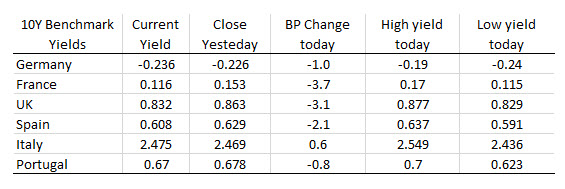

The German 10 year yield is below the 2016 low at -0.189% still.

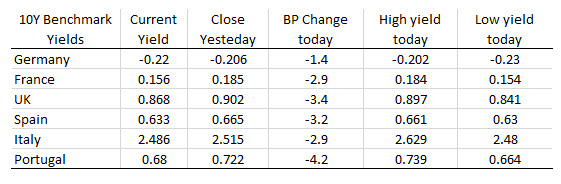

The German 10 year yield is below the 2016 low at -0.189% still.

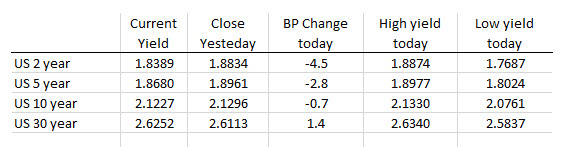

Asian stocks are on the up today as markets are cheering the fact that Mexico manages to avoid tariffs – for now – from the US following Trump’s announcement over the weekend. That has helped put risk assets in a good mood to start the week with global equities sentiment improving and Treasury yields also higher on the day.

There’s also a hint of optimism that trade talks between US and Mexico will see some positive news before the week ends, so that’s lending to better sentiment in Asian trading today. That said, markets will still be keeping a watchful eye on further talks during the US session and also on the non-farm payrolls data to come later today.

in the US stock market, the markets have been whipping around. Both the S&P and NASDAQ gave up solid early gains, and moved into the red (negative), but are now both higher again. The snapshot as London/European traders look to exit show

in the US stock market, the markets have been whipping around. Both the S&P and NASDAQ gave up solid early gains, and moved into the red (negative), but are now both higher again. The snapshot as London/European traders look to exit show

The European shares are closing the day with solid gains. There is less trade worries today and short/hedges are being squeezed a bit.

The closes are showing:

The US stock market is also positive today and near session highs as London/European traders look to exit:

In the European debt markets, the benchmark 10 year yields are ending mostly lower but off the lowest levels (UK yields moved higher today).

In the forex market, the AUD is now the strongest currency. The GBP was the strongest at the start of the day. The JPY is the weakest (on the back of higher stocks basically). For the USD, the sum of the % gains (EUR, JPY and CHF) and the % losers today (GBP, CAD, AUD and NZD) is equal to 0.0%. The dollar is perfectly mixed with some gains and some losses.

Sentiment remains cautious for the most part but Japanese stocks settled near unchanged levels after weighing between softer risk sentiment overnight along with more decent tones in trading today. US equity futures are up by around 0.1% while Treasury yields are also higher as we begin the session.