Tokyo’s main index fails to breach the 100-day moving average

Japanese stocks are closing at their lows amid fresh protests in Hong Kong regarding the China extradition bill, which is weighing on sentiment in the region today. The Hang Seng index is languishing at its lows, down by 1.8% currently.

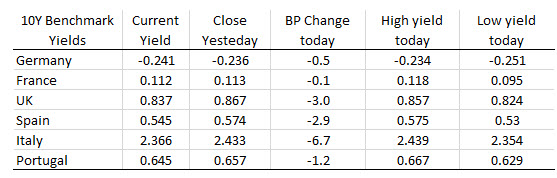

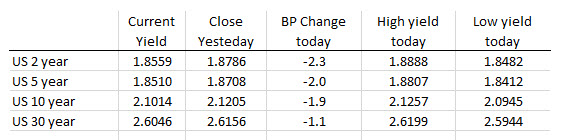

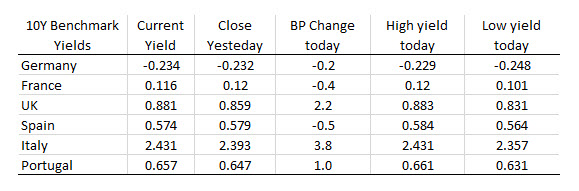

That and global trade tensions is starting to put a bit of weight on risk assets in the past hour with Treasury yields inching lower alongside US equity futures, which are down by nearly 0.2% as we begin the session.

This is helping to keep the yen a little bid with USD/JPY slipping to 108.35 now. As mentioned earlier, with little on the economic calendar, expect changes in the risk mood to be the notable market driver in the European morning.