10 year yields are lower in Europe

The European equity markets closed and the major indices are ending with gains:

- German DAX, +0.47%

- France’s CAC, +0.4%

- UK’s FTSE, +0.46%

- Spain’s Ibex, 0.2%

- Italy’s FTSE MIB, +0.8%

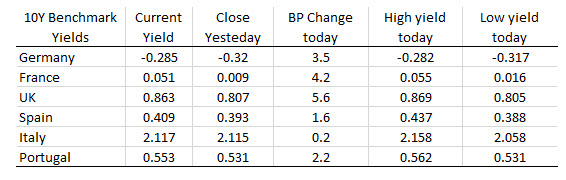

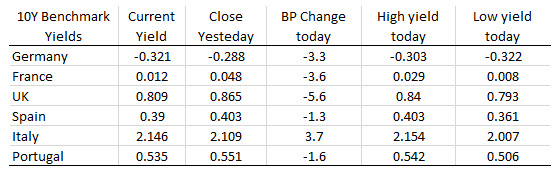

In the benchmark 10 year note sector, yields are mostly lower (with the exception of the Italy BTP).

France’s 10 year yield on June 18th, moved to -0.01% (all time low). Today, the yield dipped to a low of 0.008%. Germany’s 10 year is already negative at -0.321%. Spain is only 39 basis points from going negative. Rates are pushing on a string.

France’s 10 year yield on June 18th, moved to -0.01% (all time low). Today, the yield dipped to a low of 0.008%. Germany’s 10 year is already negative at -0.321%. Spain is only 39 basis points from going negative. Rates are pushing on a string.