Most major indices up over 1%. UK FTSE lags as they digest PM Johnson

The major European shares are ending the session with solid gains, with most of the indices enjoying gains over 1% on the day.

The provisional closes are showing:

- German DAX, +1.8%

- France’s CAC, +1%

- UK’s FTSE, +0.7%

- Spain’s Ibex, +1.5%

- Italy’s FTSE MIB, +1.01%

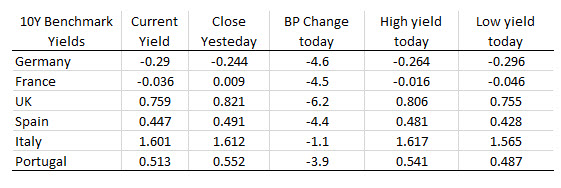

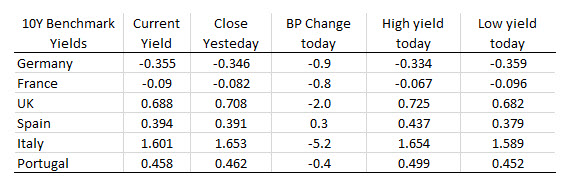

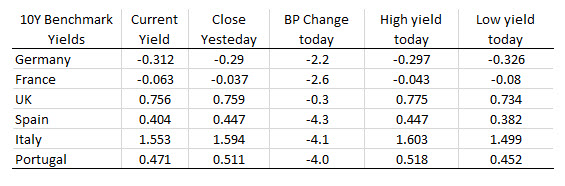

In the European debt market, the 10 year benchmark yields are ending the session with mixed results:

In other markets as it European traders look for the exits:

- spot gold is down $-2.80 or -0.20% at $1422.20

- WTI crude oil futures are trading unchanged at $56.22

In the US stock market, the major indices have given up some of their gains. The Nasdaq is trading above and below the unchanged level currently

- S&P index +0.16%

- NASDAQ index, -0.02%

- Dow +0.17%

In the forex, the USD is the strongest of the majors with solid gains vs the EUR, AUD and NZD, the NZD is the weakest:

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: