Mixed mood observed among Asian equities

Japanese investors took heart in the Fed keeping rates on hold yesterday with Fed chair Powell reiterating a message of not hiking rates until inflation is seen rising significantly.

Japanese investors took heart in the Fed keeping rates on hold yesterday with Fed chair Powell reiterating a message of not hiking rates until inflation is seen rising significantly.

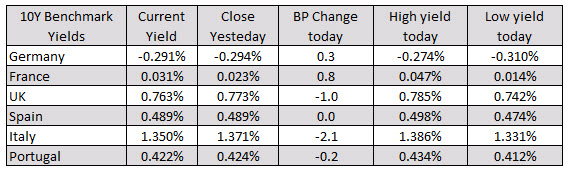

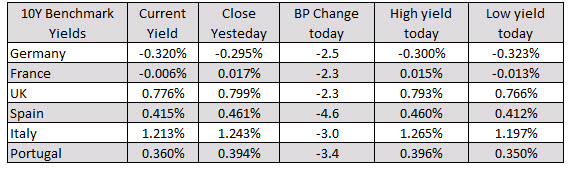

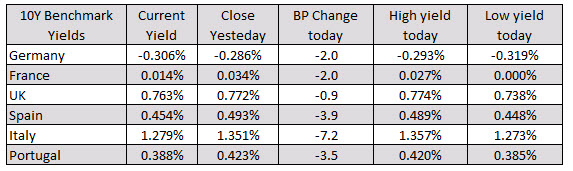

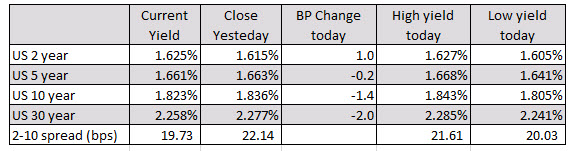

In the European debt market, benchmark yields are lower with the Spain’s Ibex down the most at -4.6 basis points. France’s 10 year yield move back below the 0.0% level at -0.006% (just below but still negative).

This largely mirrors the mood in Wall St overnight, which failed to take heart in reports that Trump is planning a delay on China tariffs later this week.

It has been a quiet session for Asian stocks as markets are staying more cautious and reserved today in anticipation of key risk events still to follow later in the week.

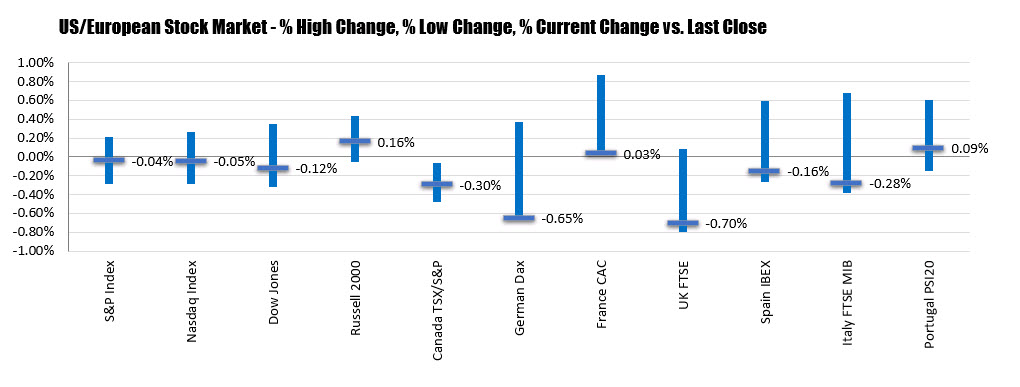

The major European indices are ending the the week mostly lower. However, they are higher in trading today. Markets are liking the strong US job growth (good for global growth) and hopes that US, China trade progress can continue.