Asian equities rebound amid positive cues since overnight trading

Wall Street posted decent gains in overnight trading and Chinese markets are also observing more calm on the day, helping to give investors a morale boost after the more tepid and cautious tone in Asia Pacific trading yesterday.

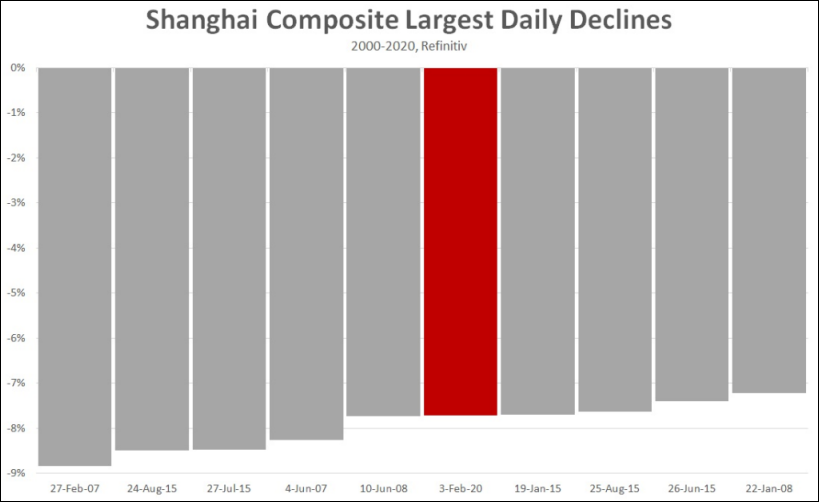

The Hang Seng is up by 1.0% while we are seeing the Shanghai Composite higher by 1.2% while the CSI 300 index is up by 2.5% on the day currently, recovering from the beatdown suffered yesterday after returning from the extended break.

US futures and Treasury yields are also keeping higher as fears surrounding the coronavirus outbreak situation is seen receding for now. That is keeping yen pairs higher on the day with USD/JPY up to 108.82 currently, while gold is down 0.3% to $1,572 at the moment.

In other markets, risk on flows are pervasive:

In other markets, risk on flows are pervasive: