Major indices down for the 4th consecutive day

The European indices are closing lower once again with today’s declines accelerating the fall. The indices have been down each day this week after peaking on Monday but failing to extend higher. The provisional closes are showing:

- German DAX, -4.0%

- France’s CAC, -4.3%

- UK’s FTSE 100, -3.7%

- Spain’s Ibex, -5.2%

- Italy’s FTSE MIB, -4.3%

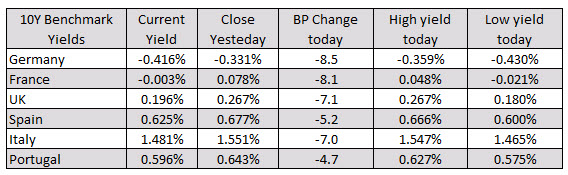

In the benchmark 10 year yields investors have been buyers across all countries today. The German 10 year note is down -8.5 basis points and is seen the most buying interest.