Chinese state media is pushing the narrative that a bull market is here

China equities are trading well higher on the day so far, with both the CSI 300 and the Shanghai Composite posting gains of over 4% currently.

What is even more impressive is that trading volumes are surging, with daily turnover exceeding ¥1 trillion on Thursday and Friday last week – and likely to exceed that mark once again today. That represents a sign of surging risk appetite.

This comes on the back of news that China International Capital Corp. is forecasting the stock market to double in the next 5-10 years while the Securities Times’ said a “healthy” bull market is now more important to the economy than ever.

Frankly speaking, China trying to “guide” asset prices towards one direction isn’t anything new and any state media narrative is often a strong hint of what local authorities are willing to do in order to support said narrative to turn it into reality.

Of note, Bloomberg highlights that the number of mainland commentaries and retweets containing the term “bull market” over the weekend was more than 10 times the average that is seen over the past 90 days, according to the Baidu index.

That’s pretty much all investors need so long as state media and local authorities are also pushing the same narrative, reaffirming the technical breakouts since last week.

While China is continuing to signal that they have moved on from the coronavirus, the more bullish tone is feeding into risk-on sentiment across markets today. However, coronavirus developments elsewhere are less than ideal or convincing.

Sure, the sheer exuberance could override fears for a day or two but it won’t change the fact that we are still likely to see more pessimistic news over the next few weeks on virus developments elsewhere – especially the US – unless something changes.

It’ll be interesting to see how the market decides to interpret that version of reality when push comes to shove.

For today, look out for the S&P 500 as futures (up by over 1%) are pointing towards the cash market testing key daily resistance at 3,153 to 3,155 once again:

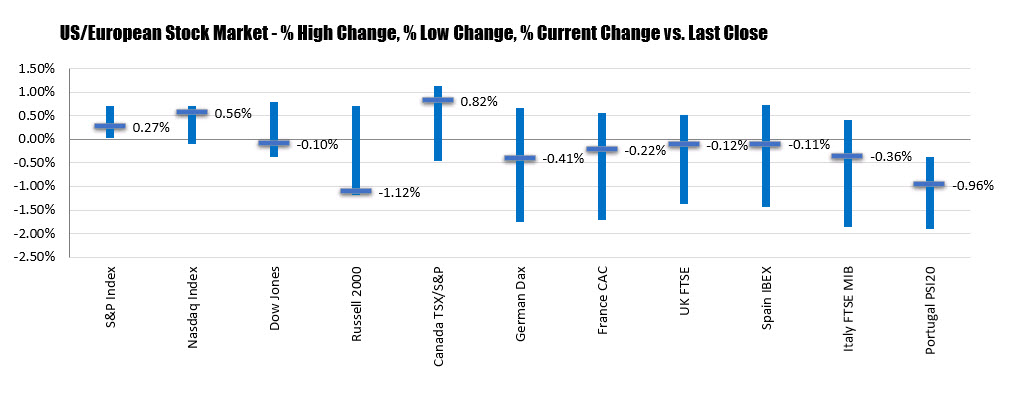

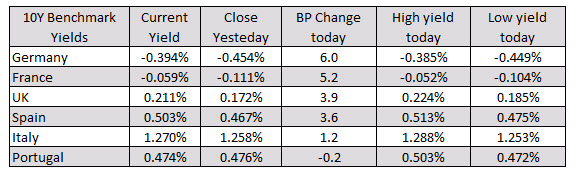

In other markets:

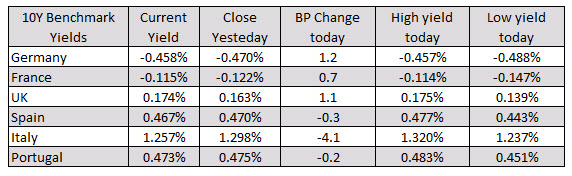

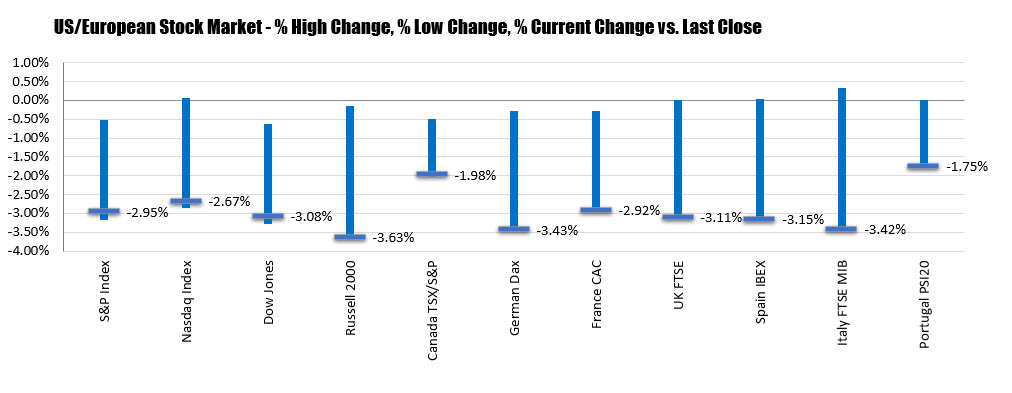

In other markets:

The US shares are also currently trading at session lows with the Dow industrial average leading the way to the downside with a -3.08% decline.

The US shares are also currently trading at session lows with the Dow industrial average leading the way to the downside with a -3.08% decline.