Archives of “Global Indices” category

rssEuropean indices end the day in the red

Indices close near lows for the day

The European indices are ending the day lower and also closing near the lows for the day.

The provisional closes are showing:

- German DAX, -0.5%

- France’s CAC, -1.4%

- UK’s FTSE 100, -1.1%

- Spain’s Ibex, -1.7%

- Italy’s FTSE MIB, -0.7%

For the week, the indices are down sharply:

- German DAX -4.0%

- France’s CAC -3.49%

- UK’s FTSE 100, -3.25%

- Spain’s Ibex, -5.7%

- Italy’s FTSE MIB, -4.9%

For the month, the German DAX closed near unchanged. The other indices were lower:

- German DAX, unchanged

- France’s CAC, -3.1%

- UK’s FTSE 100, -4%

- Spain’s Ibex, -4.9%

- Italy’s FTSE MIB, -1.46%

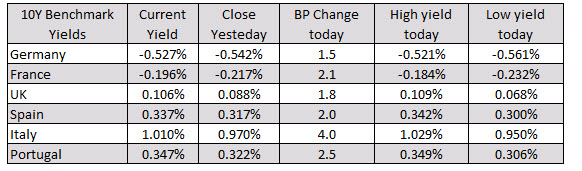

In the benchmark 10 year yields today, yields have moved back higher after being negative at the start of the North American session

Nikkei 225 closes lower by 2.82% at 21,710.00

A rough end to the week for Japanese stocks

The Nikkei is ending the week on a softer note, as fears surrounding domestic and global growth are still evident amid the escalating virus situation in Japan and the US. The stronger yen also weighed on exporters as we see USD/JPY fall to 104.00 levels.

On the week, the Nikkei is seen down by over 4%.

Elsewhere, the Hang Seng is down 0.3% while the Shanghai Composite is keeping higher by 0.2% in a bit of a mixed session for Chinese equities today.

The broader picture paints a more cautious and defensive risk tone in Asian trading this week. For today, US futures are keeping calmer near flat levels but Nasdaq futures are higher after earnings beats from key tech giants overnight.

In the currencies space, the dollar is still among the laggards as we see EUR/USD inch towards 1.1900 and cable looking to keep a break above 1.3100.

Closing changes for the main European bourses:

- UK FTSE -2.5% (worst since June 24)

- German DAX -3.65% (worst since June 11)

- French CAC -2.4%

- Spain IBEX -2.7%

- Italy MIB -3.4%

That’s a rough one.

European equity close: Watch and wait ahead of the Fed

Closing changes for the main bourses:

- UK FTSE 100 flat

- German DAX flat

- French CAC +0.7%

- Italy MIB -0.3%

- Spain IBEX -0.4%

Italian stocks have backtracked after trying to break out in the middle of the month.

Nikkei 225 closes lower by 1.15% at 22,397.11

Asian equities trade more mixed on the session

Japanese stocks end the day lower, following the softer mood from Wall Street overnight as risk sentiment keeps more cautious ahead of the Fed later today.

The mood in Asia is more mixed with the Hang Seng up by 0.3% while Chinese equities are gaining strongly, with the Shanghai Composite up 1.5% on a technical rebound and bargain hunting following a correction last week.

Overall, the risk mood is rather stalled as the focus turns towards the FOMC meeting later. Major currencies are keeping in narrower ranges still, with USD/JPY seen just above 105.00 and AUD/USD seen around 0.7165 – little changed on the day.

European stocks are ending mixed

Major indices off the session lows

The major European stock indices are ending the session with mixed results. However most of the indices are well off there intraday lows. The provisional closes are showing

- German DAX up 0.06%. The low was at -0.72%

- France’s CAC, -0.11%. The low was at -0.93%

- UK’s FTSE 100, +0.49%. The low was at -0.35%

- Spain’s Ibex, +1.0%.. The low was at unchanged

- Italy’s FTSE MIB, -0.5%. The low was at -1.6%

Nikkei 225 closes lower by 0.26% at 22,657.38

A mixed session for Asian equities

Japanese stocks climbed earlier but amid a pullback in gold, the risk mood sort of adjusted a little in trading today as Asian equities also pare some of its earlier gains.

The Nikkei is finishing the day lower while the Hang Seng and Shanghai Composite are both sitting up by ~0.4% currently. Elsewhere, S&P 500 futures are trading at flat levels after having observed about a 14 points gain earlier in Asia Pacific trading.

In the currencies space, the dollar is keeping slightly firmer but gains aren’t really too significant for the time being. EUR/USD is lower at around 1.1740, while USD/JPY is hovering close to 107.50 as we look towards the start of the European session.

Nikkei 225 closes lower by 0.16% at 22,715.85

Little change in the Nikkei after the 4-day weekend

That said, Japanese stocks did recover from an early setback today so that is a positive takeaway for risk buyers when looking at the overall mood.

The Hang Seng is down by 0.4% amid the virus situation in Hong Kong – local infections hit another record high over the weekend – which is likely to prompt the city to ban dine-in services at restaurants to curb the spread of infections.

Meanwhile, the Shanghai Composite is up by 0.1% as Chinese equities are keeping a little firmer. Elsewhere, US futures are seen up by 0.4% currently.

In the currencies space, this is feeding into a weaker dollar as the trend continues from the end of last week. USD/JPY is holding a break under 106.00 while EUR/USD is looking perky as it trades slightly above 1.1700 for the time being.

European shares end the day lower

German DAX falls close to 2% on the

The European markets are closed for the day and the week, and the results today showed sharp falls in the major indices. The provisional closes are showing:

- German DAX, -1.97%

- France’s CAC, -1.57%

- UK’s FTSE 100, -1.41%

- Spain’s Ibex, -1.0%

- Italy’s FTSE MIB, -1.8%

For the week, the major indices are also trading lower:

- German DAX, -0.60%

- France’s CAC -2.27%

- UK’s FTSE 100, -2.6%

- Spain’s Ibex -1.78%

- Italy’s FTSE MIB -1.6%