Mildly softer tones in early trades

- German DAX futures flat

- UK FTSE futures -0.2%

- Spanish IBEX futures -0.1%

The European shares are ending the day lower. The UK FTSE has fallen -1.1%. The Bank of England was very cautious about the prospects for the economy, but said that negative rates are not being considered (at least at the moment).

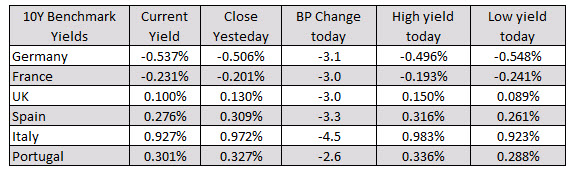

In the European debt market, the benchmark 10 year yields all fell on the day.

US stocks have seen their share of ups and downs as well

Asian stocks are on the retreat in trading today as investors continue to weigh up the virus situation globally as well as the stalemate between US lawmakers on a stimulus deal, alongside the more exuberant mood in Wall Street overnight.

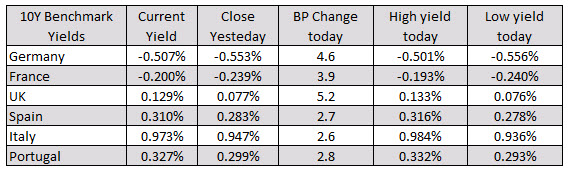

In the European debt market, the benchmark 10 year yields are all trading to the upside. The UK 10 year is leading the way with a 5.2 basis point gain.

The provisional closes for the European markets are showing solid gains to start the week, led by the German DAX.