Spain and Italy shares move lower

- German DAX, +0.3%

- France’s CAC, +0.3%

- UK’s FTSE 100, +0.8%

- Spain’s Ibex, -0.88%

- Italy’s FTSE MIB, -0.25%

Japanese stocks are lower to start the week, as we see a bit more subdued tones outside of the more positive mood in Chinese equities – which owed to the PBOC’s liquidity injection earlier in the day here.

This follows the more positive mood from Wall Street overnight, as the market keeps calmer for the most part to start the new day as well. The Hang Seng is down a little by 0.1% but the Shanghai Composite is up by 0.3% currently.

As London/European traders look to exit, the CHF remains the strongest. The JPY has taken over as the weakest of the majors. The USD has moved lower in the NY session (compared to opening levels). It is now mostly lower with declines vs. the CHF, EUR, CAD, AUD and NZD and gains only vs the JPY. It is back to unchanged vs the GBP after being higher vs the pound at the start of the day.

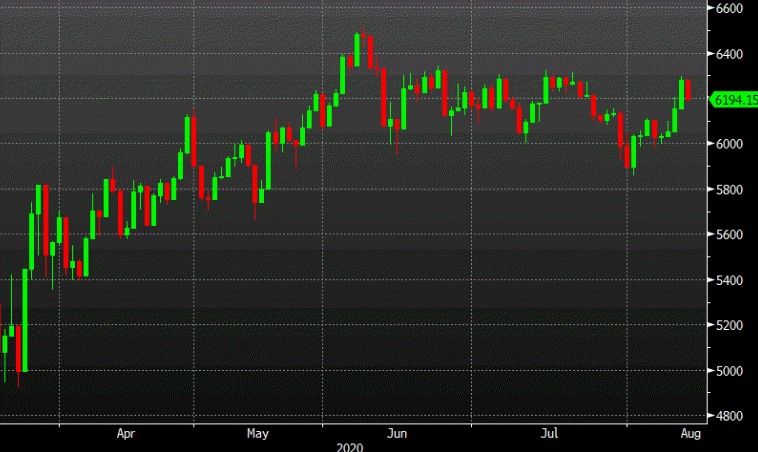

The flow funds into the European markets continue today with sharp moves to the upside in the major indices. A look at the provisional closes are showing:

The major European stock indices are ending the session flat or higher. The German DAX was the weakest as it closes near flat for the day. Spain’s Ibex is the strongest with a gain of near 1.4%.