Asian equities mostly advance after Wall Street gains yesterday

Asian equities are seeing rather muted tones in general, though they are off earlier lows at least but are failing to find much inspiration after the mixed tones in Wall St overnight.

Europe weekly:

Japanese stocks were faring better on the day, rising alongside its peers in the region, before reports came in that Abe is to resign as prime minister. That sent Japanese markets into a risk-off spin, though the reaction outside of Japan is rather muted.

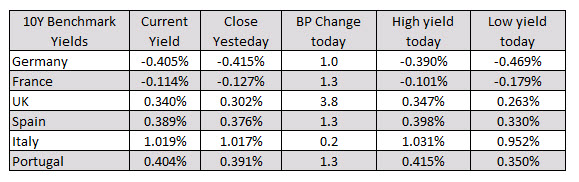

In the European debt market, the benchmark 10 year yields reversed earlier declines and are currently trading up 0.2 basis points to up 3.8 basis points:

As the London/European traders look to exit, the CAD is the strongest while the JPY is the weakest. The USD has seen volatile up and down trading but is still trading mostly higher but with most of the gains vs. the JPY and EUR. The greenback is lower vs. the CAD, and near unchanged vs. the GBP, CHF, AUD and NZD (all are within 0.07% of unchanged on the day).

As the London/European traders look to exit, the CAD is the strongest while the JPY is the weakest. The USD has seen volatile up and down trading but is still trading mostly higher but with most of the gains vs. the JPY and EUR. The greenback is lower vs. the CAD, and near unchanged vs. the GBP, CHF, AUD and NZD (all are within 0.07% of unchanged on the day).

The European shares are ending the session higher. The laggard is the UK FTSE 100 which rose by a scant +0.1%. The gains were also varied with the German DAX leading the way at +1.0%. Shares move higher on Monday but gave back some of the gains on Tuesday.

The major European indices give up gains of over 1% and are ending the day around or below unchanged (and at session lows). The UK FTSE is the biggest decliner. The GBP is also the strongest currency on the day.