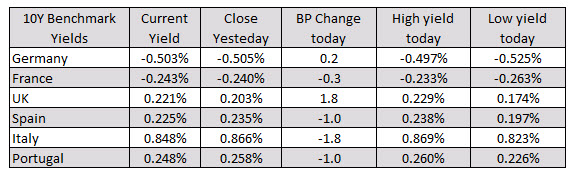

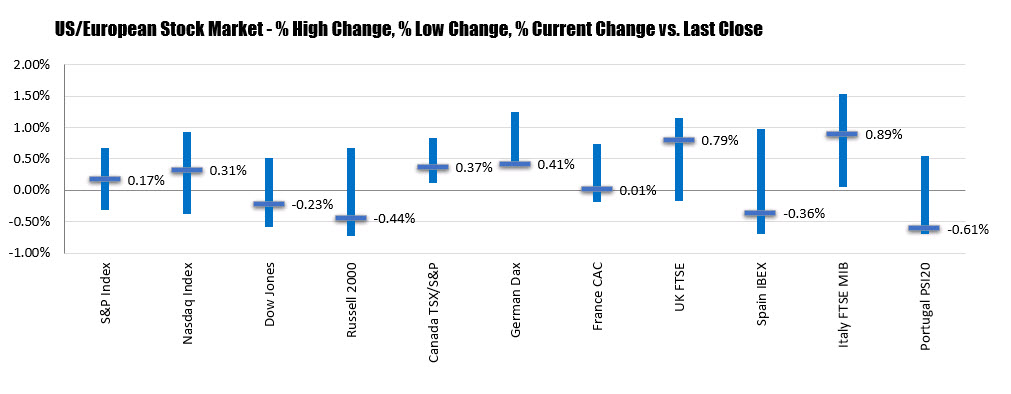

UK FTSE outperforms

The major European indices are closing higher. However, most are closing near their session lows. The one exception is the UK FTSE which has the largest gain and closed near mid range.

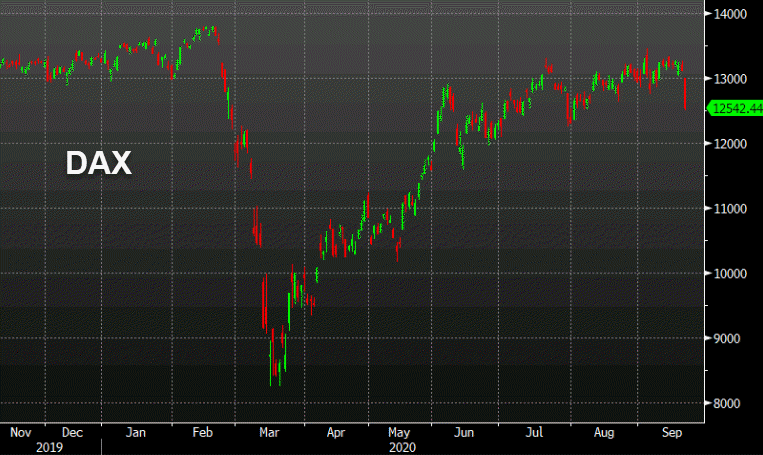

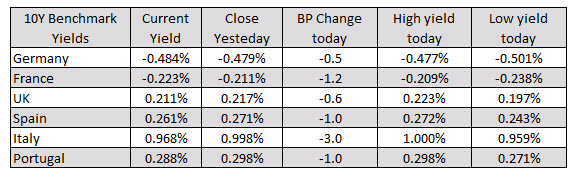

- German DAX, +0.5% after trading as high as 1.88%

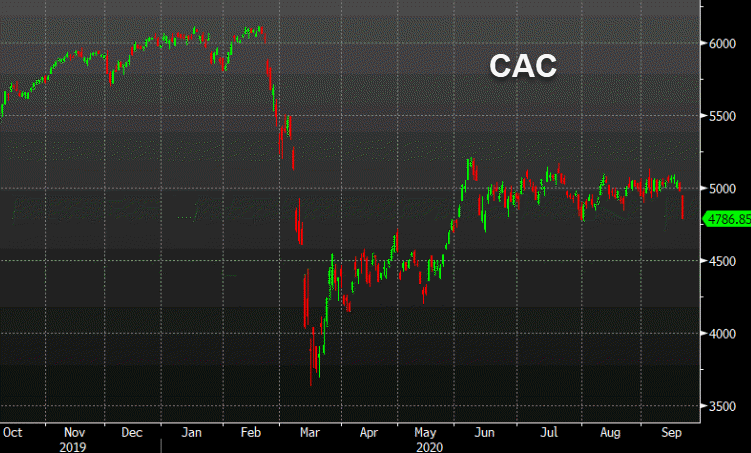

- France’s CAC, +0.8% after trading as high as +2.07%

- UK’s FTSE 100, up 1.3%, after trading as high as 2.49%

- Spain’s Ibex, +0.4% after trading as high as 1.99%

- Italy’s FTSE MIB, is up 0.3% after trading as high as 1.78%

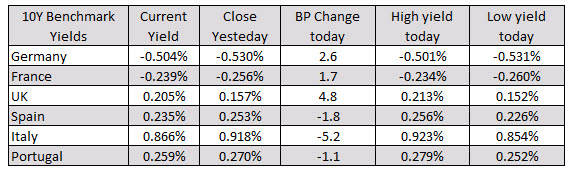

In other markets as London/European traders head for the exits:

In other markets as London/European traders head for the exits:- spot gold is continuing the tumble lower (following the clues from the higher USD) and trades down $-33.00 or -1.77% at $1866.48.

- Spot silver is also sharply lower by $1.35 or -5.55% to $23.04

- WTI crude oil futures are up $0.22 at $40.02

In other markets as London/European traders look to exit are showing:

In other markets as London/European traders look to exit are showing: