Nikkei closes near flat but well off earlier lows

Asian equities slumped early on, following US stocks overnight but have recovered some ground in late trading as US futures rose ahead of European morning trade.

Trump sent risk assets packing yesterday but attempted to somewhat walk back on those remarks with more tweets earlier, offering some piecemeal concessions to stimulus talks.

That could be what is helping to see the risk mood recover a little but let’s be real, there is no way the Democrats will accept any of that to help his current plight.

Elsewhere, major currencies are still keeping little changed but the slight nudge higher in US futures is keeping USD/JPY a little elevated at 105.75, near resistance at 105.80.

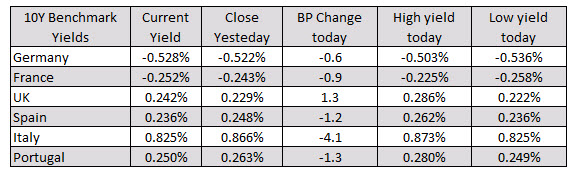

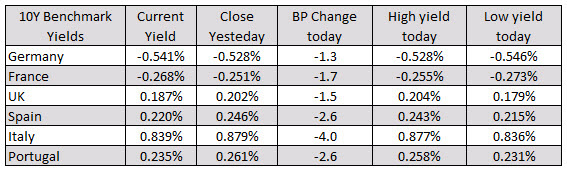

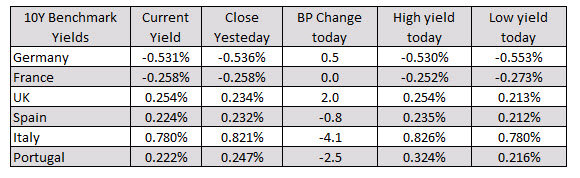

In other markets as the European/London traders look to exit for the weekend:

In other markets as the European/London traders look to exit for the weekend: