Asian equities lower following Wall Street yesterday

The risk mood is more on the defensive to start the day, with Asian stocks also slumping amid more US stimulus setback that weighed on US equities yesterday.

The Hang Seng is down 1.3% while the Shgnahi Composite is near flat levels, keeping more subdued throughout the session. Elsewhere, US futures are also keeping lower and that is setting up a softer mood ahead of European trading today.

In the currencies space, things are little changed for now but just be mindful of how the risk mood plays out as that could see flows in/out of the dollar in the session ahead.

EUR/USD is keeping within a 17 pips range so far, little changed at 1.1752 currently.

![What are the GLOBAL INDICES to see before taking a trade [HINDI]? - YouTube](https://i.ytimg.com/vi/7FqMmIuAbMI/maxresdefault.jpg)

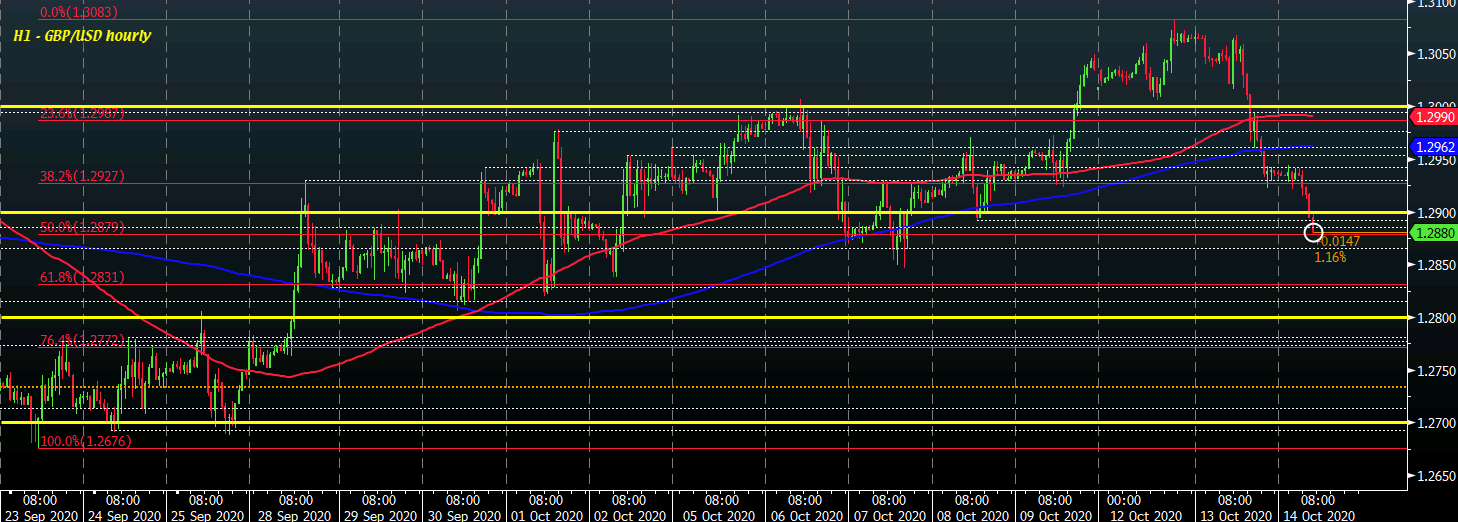

A snapshot of the forex market as London/European traders look to exit shows the AUD is the strongest and the JPY is the weakest. That was the order at the start of the NY session. However, each have increased their relative advantages. The GBP was lower at the start of the New York session, but with all the Brexit chatter from EU and UK officials, the GBP has moved higher in the NY session. The USD has weakened in the the NY session with the greenback losing ground vs. both the GBP and the AUD over the last 4 or so hours.

A snapshot of the forex market as London/European traders look to exit shows the AUD is the strongest and the JPY is the weakest. That was the order at the start of the NY session. However, each have increased their relative advantages. The GBP was lower at the start of the New York session, but with all the Brexit chatter from EU and UK officials, the GBP has moved higher in the NY session. The USD has weakened in the the NY session with the greenback losing ground vs. both the GBP and the AUD over the last 4 or so hours.