A softer day for Asian equities

Stocks in Asia are largely following the mood from Wall Street yesterday, as stimulus talks get dragged on again and hopes for a pre-election deal continue to fade. US futures being marked lower by ~0.5% also isn’t really helping with sentiment so far today.

The Hang Seng is seen closer to flat levels, erasing some of its earlier losses while the Shanghai Composite is down by 0.6% but also off lows seen earlier in the session.

In the major currencies space, the more cautious mood is seeing the dollar keep a slight advance across the board as it retraces some of the losses from yesterday.

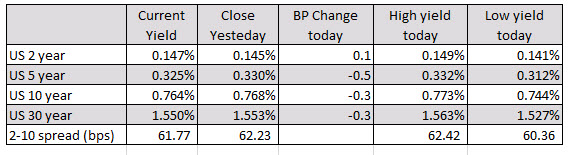

The more interesting action in the bond market yesterday is meeting a bit of a check, with 10-year Treasury yields seen lower by 1.5 bps to 0.807% currently.

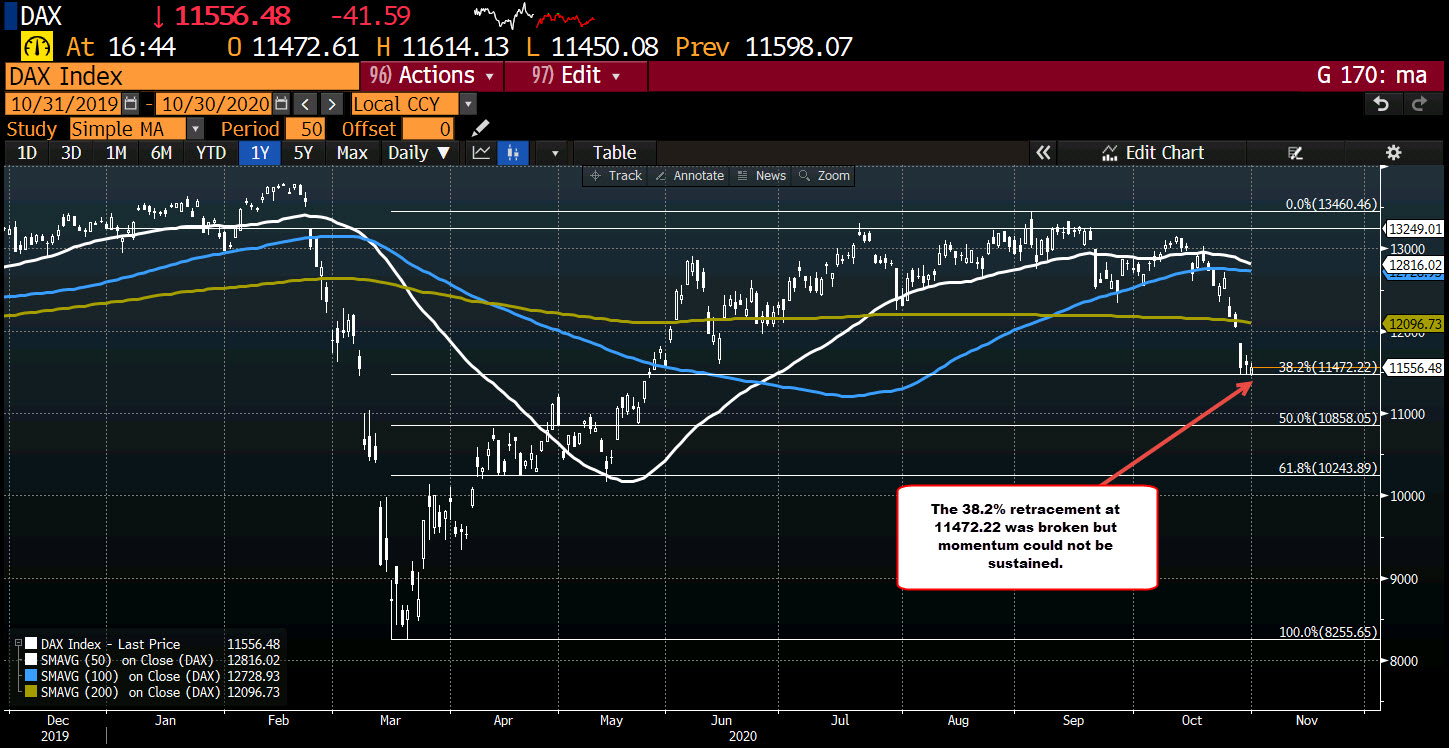

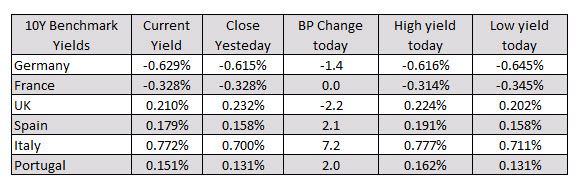

A look at other markets as London/European traders look to exit shows:

A look at other markets as London/European traders look to exit shows: