Archives of “Global Indices” category

rssCrucial Update :Global Indices →#Bovespa #Nikkei #FTSE100 #CAC #DAX #RTSI #ShanghaiComposite -Anirudh Sethi

To read more enter password and Unlock more engaging content

Stock market capitalization worldwide hits a new high of $ 93.5 trillion. This represents approximately 107% of world GDP.

Not all stock exchanges are the same.

European shares snap a 4-day win streak

Strong gains this week for the major indices.

The European equity markets are closing for the week. The major indices are ending lower snapping a 4 day win streak. Nevertheless the gains for the week are strong.The provisional closes are showing:

- German DAX, -0.7%

- France’s CAC, -0.6%

- UK’s FTSE 100, flat

- Spain’s Ibex, -0.8%

- Italy’s FTSE MIB, -0.2%

For the week, provisional closes are showing;

- German DAX, +8%

- France’s CAC, +7.8%

- UK’s FTSE 100, +5.9%

- Spain’s Ibex, +6.5%

- Italy’s FTSE MIB, +9.7%.

In other markets as European/London traders look to exit:

- spot gold is trading up $2.40 or 0.12% at $1952.11

- spot silver is up $0.11 or 0.46% $25.48

- WTI crude oil futures are trading down $1.22 at -3.15% at $37.57.

- Bitcoin is off the high level of $15,966.49. It currently trades at $15,514.30

In the US stock market, the S&P index has moved back into the black marginally:

- S&P index up 0.37 points or 0.01% of 3511

- NASDAQ index is down 13 points or -0.11% 11878.00

- Dow industrial average is down 13 points or -0.05% of 28377

- 2 year 0.152%, 0.8 basis points

- 5 year 0.367%, +4.41 basis point

- 10 year 0.825%, +6.2 basis points

- 30 year 1.602%, +7.8 basis points

European shares close higher for the 4th consecutive day

Solid gains once again for the major indices

The European shares are closing higher for the 4th consecutive day. The gains are led by Spain’s Ibex and Italy’s FTSE MIB which are up over 2%.The provisional closes are showing

- German DAX, +1.9%

- France CAC, +1.2%

- UK’s FTSE 100, +0.3%

- Spain’s Ibex, +2.0%

- Italy’s FTSE MIB, +2.0%

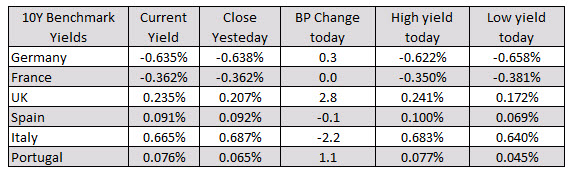

The European debt market, the benchmark 10 year yields are mixed with Italy and Spain yields down, and German, UK and Portugal yields up. The French 10 year yield is unchanged on the day.

In other markets as European traders look to head for the exits:

In other markets as European traders look to head for the exits:- Spot gold is surging. The price is currently up $43 or 2.28% at $1946.32.

- Spot silver is also up sharply. It is currently up 100 and $0.11 or 4.64% at $25.01

- WTI crude oil futures trading down $0.43 or -1.12% at $38.71

European shares enjoy their 2nd consecutive up day

The recovery from last week’s rout continues

The major European indices are enjoying their 2nd consecutive up day and clawing back losses from last week. The German DAX fell -8.6% last week. Italy’s FTSE MIB fell by around -7%. France’s CAC and Spain’s Ibex fell by -6.4% in the UK FTSE fell by about -5%. It was ugly.Lower this week has seen a nice rebound. The provisional closes are showing:

- German DAX, +2.5%

- France’s CAC, +2.4%

- UK’s FTSE 100, +2.2%

- Spain’s Ibex, +2.6%

- Italy’s FTSE MIB, +3.0%

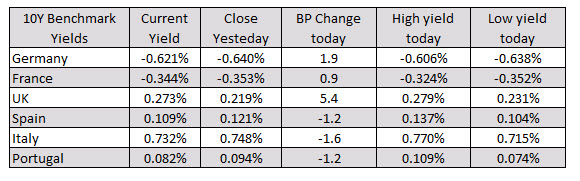

in the European debt market, the benchmark 10 year yields are mixed with investors pushing into the more risk year countries including Spain, Italy, and Portugal (rates are lower in those countries), while selling Germany, France and the UK (rates are higher in those countries).

In other markets as London/European traders exit for the day.

In other markets as London/European traders exit for the day.US stocks throwing caution to the wind ahead of the election:

- S&P index is up 78 points or 2.36% 3388.30

- NASDAQ index is up 244 points or 2.23% at 11200

- Dow industrial average is up 680 points or 2.5% at 27603

In the US debt market, yields are higher with the yield curve steepening. The 2 – 10 year spread is up to 71.88 basis points from 68.89 basis points at the close yesterday:

European shares rebound after last week’s collapse

German Dax up 1.9% after last week’s decline of -8.6%

The European indices are rebounding higher today after last week’s collapse. Last week the- German DAX fell -8.6%,

- France CAC fell -6.2%

- UK FTSE was down by around -5%.

Today the provisional closes are showing:

- German DAX, +2.0%

- France’s CAC, +2.0%

- UK FTSE 100, +1.4%

- Spain’s Ibex, +2.0%

- Italy’s FTSE MIB, +2.2%

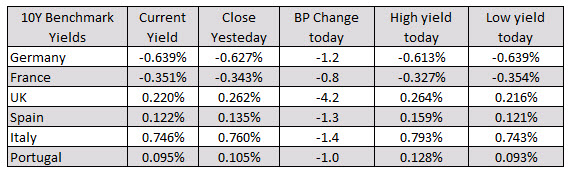

In the European debt market, the benchmark 10 year yields saw yields move lower on concerns about lower growth and potentially more stimulus by the ECB in December. The UK 10 year is down -4.2 basis points leading the way to the downside.

In other markets as London/European traders look to exit shows:

- Spot gold is up $13 or 0.7% at $1891.96

- Spot silver is trading up $0.23 or 0.97% $23.88

- WTI crude oil futures are trading up $0.25 or 0.7% $36.04

In the US stock market, the major indices are higher led by the Dow industrial average (up 1.5%), but off there highest levels. The NASDAQ index lags with only a 0.37% gain.

- S&P index up 1.23%

- Dow industrial average up 1.53%

- NASDAQ index up 0.35%

In the US debt market, yields are lower, despite the rise in equities today:

- 2 year 0.152%, unchanged

- 5 year 0.367%, -1.7 basis points

- 10 year 0.835%, -3.8 basis points

- 30 year 1.615%, -4.4 basis points

Nikkei 225 closes higher by 1.39% at 23,295.48

A more upbeat day for Asian equities

The Nikkei is also rebounding upon a test of its 100-day moving average and the 2 November low, with better Chinese factory data earlier helping with sentiment in the region. The Hang Seng is up 1.1% while the Shanghai Composite is up just 0.1%.

It is a bit of a quiet one to start the new week, with US futures keeping calmer and up by ~0.2% while major currencies are reflecting little change for the most part.

AUD/USD is testing the 0.7000 handle as commodity currencies struggle a little while GBP/USD is lingering close to 1.2900 as the UK goes back into lockdown, overshadowing murmurs of some headway made on the Brexit front.

Global Indices :An UPDATE → #DJIA #SPX500 #NASDAQCOMPOSITE #BOVESPA #FTSE #CAX #DAX #RTSI -Anirudh Sethi

To read more enter password and Unlock more engaging content