France’s CAC, Italy’s FTSE MIB close higher

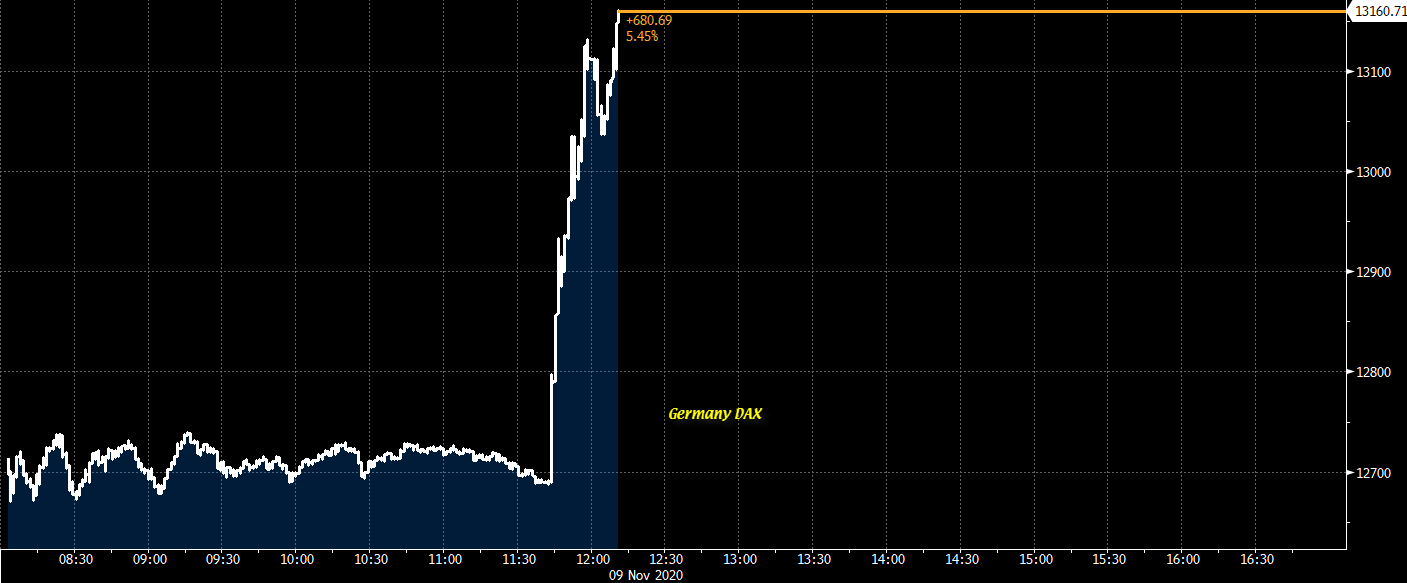

The major European indices are ending the day with mixed results. The provisional closes are showing:

- German DAX, -0.1%

- France’s CAC, +0.2%

- UK’s FTSE 100, -0.9%

- Spain’s Ibex, -0.6%

- Italy’s FTSE MIB, +0.7%

In other markets as European/London traders look to exit:

- Spot gold is trading down $2.45 or -0.13% $1886.36.

- Spot silver is trading down $0.19 or -0.78% at $24.57

- WTI crude oil futures are trading down $0.36 or -0.87% at $40.98

A snapshot of the US stock market currently shows:

- S&P index -12 points or -0.34% at 3614.51

- NASDAQ index -23 points or -0.20% at 11900

- Dow -165 points or -0.54% to 9786

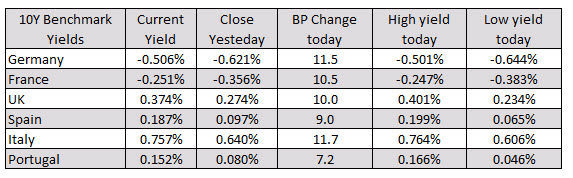

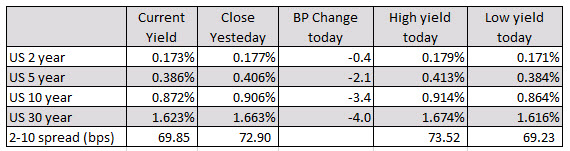

In the US in the US debt market, yields remain lower with a flatter yield curve:

In the forex, the GBP remains the strongest of the majors. The AUD has taken over the weakest from the NZD (from the stock market open snapshot). Overall, the commodity currencies remained the weakest on modest “risk-off” sentiment. The US dollar remains mixed with gains vs. CAD, AUD and NZD, and declines vs. GBP, EUR, JPY and CHF.