Archives of “Global Indices” category

rssAn Update : #DOW #NASDAQCOMPOSITE #SPX500 ,#BOVESPA #MERVAL #FTSE100 #DAX #CAC #Shanghaicomposite #Nikkei -#AnirudhSethi

To read more enter password and Unlock more engaging content

European equity close: Strong finish with Italy and Germany lagging on the week

Closing changes for the main European equity bourses:

- UK FTSE 100 +0.3%

- German DAX +0.8%

- French CAC 40 +1.0%

- Italy MIB +1.1%

- Spain IBEX +1.3%

On the week:

- UK FTSE 100 +0.8%

- German DAX -0.4%

- French CAC 40 +1.4%

- Italy MIB -1.0%

- Spain IBEX +1.4%

Nikkei 225 closes lower by 0.72% at 30,017.92

The equities rally takes more of a breather towards the end of the week

Japanese stocks see the momentum in getting above 30,000 ease a little as risk sentiment in general looks to be more weary ahead of the weekend. That said, the Nikkei still posted 1.7% gains on the week so that’s more indicative of the bigger picture.

Chinese equities are still looking rather mixed and playing catchup after the long break, with the Hang Seng down 0.2% but the Shanghai Composite is up 0.5%. However, both are trading at the highs right now as we look towards the latter stages of the session.

Elsewhere, US futures are down but off earlier lows at least with S&P 500 futuress seen down ~0.15% as we look towards European morning trade today.That is keeping the risk mood more tepid in general with the market still weighing up the moves in the bond market earlier in the week, among other things.

European traders look to head for the exits

Major indices in the red today

As European traders look to head for the exits, the major indices all moved lower in trading today.

- German DAX, -0.16%

- France’s CAC, -0.65%

- UK’s FTSE 100, -1.4%

- Spain’s Ibex, -0.8%

- Italy’s FTSE MIB, -1.11%

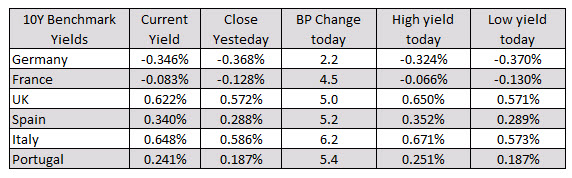

In the European debt market, the benchmark 10 year yields moved higher.

In other markets:

In other markets:- Spot gold is trading up $0.44 or 0.02% $1776.57. That is well off the high price of $1789.67.

- Spot silver is trading down $0.31 or -1.15% $27.06

- bitcoin is down $462 or -0.8% of $51,937

- WTI crude oil futures are trading down $0.13 or -0.21% at $61.01 for the March contract. For the April contract the price is down $0.17 or -0.28% at $60.99

In the US stock market, the NASDAQ and Russell 2000 index remain the weakest as investors get out of the high flyers. However all indices are lower.

- S&P index -38.30 points or -0.97% at 3893.24

- NASDAQ index -194 points or -1.4% at 13769.63

- Dow -274 points or -0.87% at 31337

- Russell 200 is down the most at -1.7%

European shares end the day in the red

German DAX, -1.1%. France’s CAC, -0.3%. UK’s FTSE 100, -0.5%

The major European shares are ending the day in the red. The declines were led by the Italian and German markets. The provisional closes are showing

- German DAX, -1.1%

- France’s CAC, -0.3%

- UK’s FTSE 100, -0.5%

- Spain’s Ibex, -0.4%

- Italy’s FTSE MIB, -1.2%

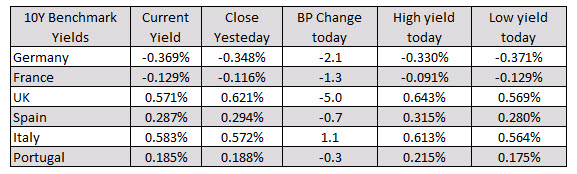

in the European debt market, the yields are ending mostly lower with UK yields down 5 basis points to leading the way. Italian yields are the only country with higher rates today. They rose by 1.1 basis point.

In other markets as London/European traders look to exit

- spot gold is trading down nearly $20 at $1774. The low price reached $1769.65 as flows followed the dollars movements (as the US dollar moves higher, the price of gold tends to move to the downside).

- Spot silver is down $0.11 or -0.39% at $27.12

- WTI crude oil futures are trading up $0.15 or 0.25% $60.20. It has had a volatile run falling from a high of $61.26 to a low of $59.43 on the back of a Wall Street article saying that Saudi Arabia was looking to rollback the voluntary production cuts.

- Bitcoin is trading up by $2497 or 5.13% at $51086. The high price reached $51,717.88

European shares close lower after giving up earlier gains

German DAX -0.3%

the major European shares are closing lower after giving up earlier gains. A look at the provisional closes shows:- German DAX, -0.3%

- France’s CAC, -0.1%

- UK’s FTSE 100, -0.1%

- Spain’s Ibex, -0.5%

- Italy’s FTSE MIB, -0.5%

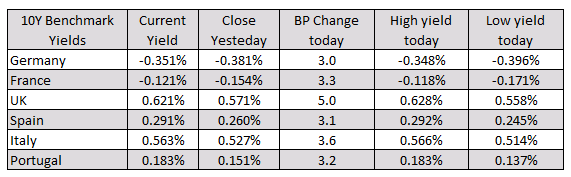

Looking at the benchmark 10 year yields, they are all moving higher, but less than the US counter part (the US 10 year yield is currently up 7.4 basis points at 1.282%).

The North American session has seen the dollar rise sharply and more recently give back back some of those gains. Nevertheless the greenback remains higher vs. all the major currencies on the day with the exception of the GBP. The JPY and CAD are the weakest of the major currencies.

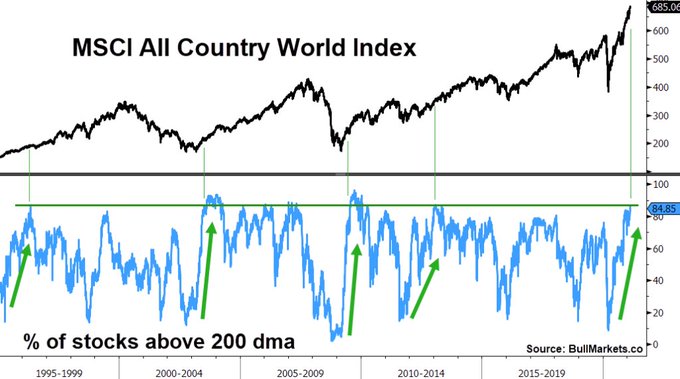

Is the Buffett indicator raising warning bells or false alarms?

Different ways to get to the same destination.

Nikkei 225 closes above 30,000 for the first time since August 1990

The Nikkei closes 1.91% higher at 30,084.15 today

Another day, another push higher in the Nikkei. What else is new? Equities are taking things in stride to start the new week, feeding off the solid close by Wall Street on Friday.

US markets may be closed but things are setting up for a more positive open as we look towards Europe. In the major currencies space, the dollar and yen are the laggards, with AUD/JPY breaking away to 81.82 – its highest levels since December 2018.