The equities selloff intensifies in Asian trading

- Nikkei -3.7%

- Hang Seng -3.1%

- Shanghai Composite -2.1%

- S&P 500 futures -0.5%

- Nasdaq futures -1.0%

- Dow futures -0.5%

- Russell 2000 futures -1.6%

Asian equities are having their worst session since 23 March last year as the selloff continues. US futures are also slumping heavily as the drop yesterday extends further. The big question is, how much more pain can investors stomach in this latest episode?

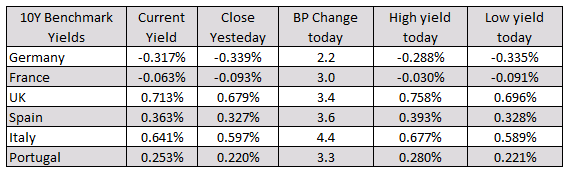

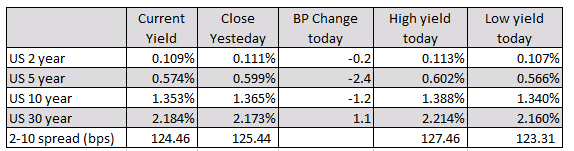

The stunning rout in the bond market yesterday led to a selloff in risk but despite calmer tones today, it isn’t yet convincing dip buyers to step in.

It is still early in the day of course but all things considered, there might be more downside in store ahead of the weekend as this may be part of a healthier correction/flush in the equities space in the bigger picture of things.

Looking at the charts, we are seeing some key levels being called into question.