The Nikkei closes near the highs for the day as losses are trimmed

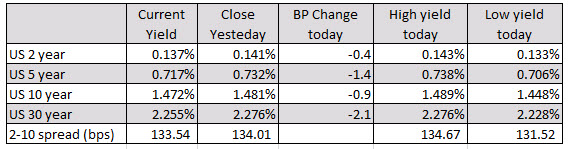

The risk mood at the tail-end of Asian trading is one that looks to be getting better as the market digests the post-Powell narrative. The BOJ has certainly helped to ease concerns in the Japanese market but Treasuries are still the key spot to watch.

Though at some point you have to wonder, where is the ceiling here before the Fed really feels the need to offer a firmer reaction? That said, the market may gather a sense of calm for now but it is still early in the day to be calling for a major turnaround.

However, given that the Fed is still pumping so much liquidity into the market and that we are set to embrace Biden’s stimulus package, are things really so bad?

The Hang Seng has also erased earlier losses to turn flat while the Shanghai Composite is trading up 0.3% going into the closing stages. Elsewhere, US futures have also pared heavier declines earlier on to keep around flat levels at the moment.