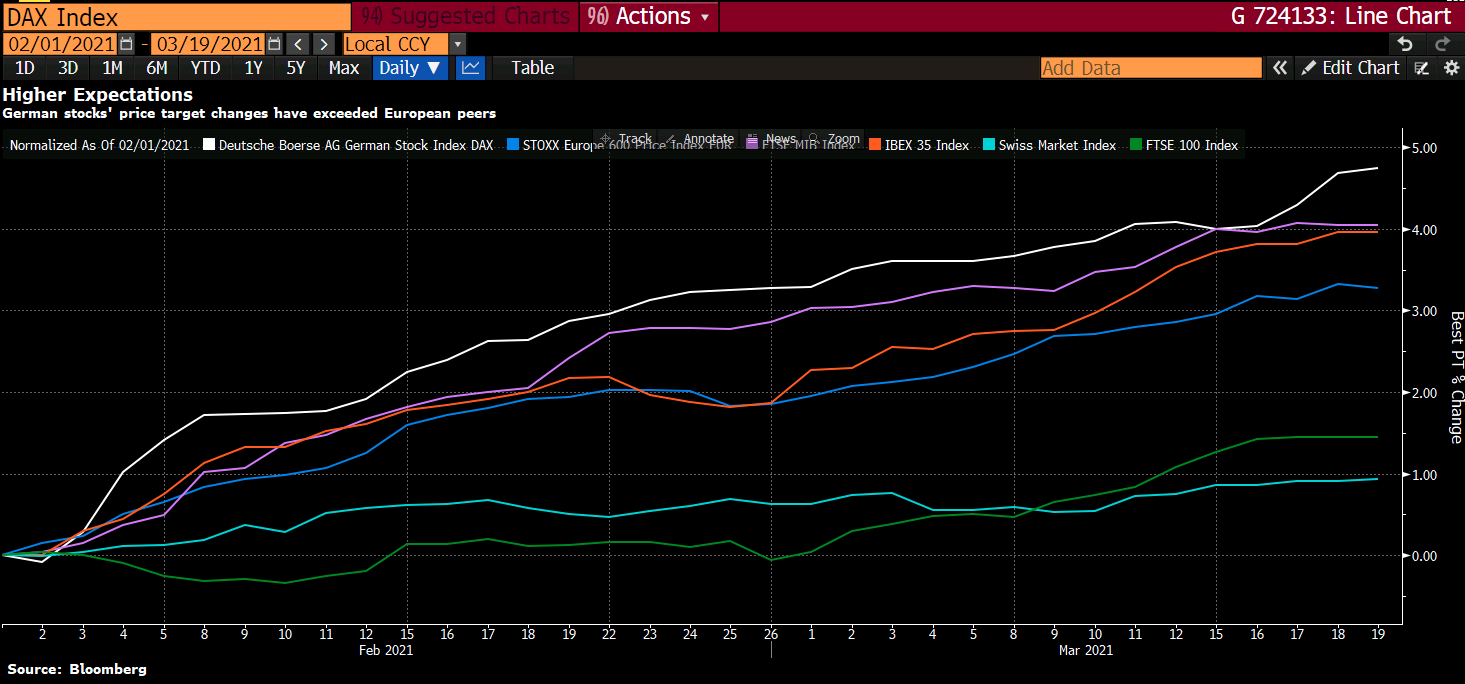

German Dax closes at a new record. France’s CAC just off all time highs

The European major indices are ending the session higher with the German Dax closing at a record level. France’s CAC is stalled just ahead of its all time high today.

- German Dax, +0.7%

- France’s CAC, +0.59%

- UK FTSE 100, +0.35%

- Spain’s Ibex, unchanged

- Italy’s footsie MIB, +0.25%

In other markets as London/European traders look to exit:

- Gold is up $20.60 or 1.21% at $1728.20.

- Silver is up $0.35 or 1.45% at $24.77

- WTI crude oil futures are up $0.56 or 0.91% at $59.70. The remains between the high price of $60.83 and the low price of $58.91 as OPEC+ meet

- Bitcoin relatively unchanged at $59,027 (up about $70)

a snapshot of the US stock market is showing:

- S&P index up 34.85 points or 0.88% at 4007.73. The index is above the 4000 level for the first time ever

- NASDAQ is up 197 points or 1.48% at 13443

- Dow is up 132 points or 0.40% at 33114

In the US debt market, yields continue to move lower:

- 2 year 0.154%, -0.6 basis points

- 5 year 0.8945%, -4.4 basis points

- 10 year 1.675%, -6.6 basis points

- 30 year 2.34%, -7.0 basis points

Today is not the best day to chase this as the reflation trade is having a wobble. Whether it is a deeper pullback in equities or not is uncertain, but there is a bit or re-orientation going on right now.

Today is not the best day to chase this as the reflation trade is having a wobble. Whether it is a deeper pullback in equities or not is uncertain, but there is a bit or re-orientation going on right now.