Archives of “Global Indices” category

rssGlobal Indices : An Update for #Nikkei #Hangseng #Shanghaicomposite #Bovespa #Merval #FTSE #DAX #CAX #RTSI #EmergingMarketsIndex -#AnirudhSethi

To read more enter password and Unlock more engaging content

$EEM / $SPY Weekly bear flag

Investors still feeling bullish about EM. Yet you have to be bearish on USD for that to work Thinking face

European shares end the session mostly higher

Italy’s FTSE MIB anexception

The major European shares are ending the session mostly higher. France’s CAC is at the highest level since 2007. The German Dax is up marginally but remains below the 15212 high close.The provisional closes are showing:

- German Dax, +0.1%

- France’s CAC, +0.6%

- UK FTSE 100, +0.7%

- Spain’s Ibex, +0.4%

- Italy’s FTSE MIB, -0.5%

In other markets as European/London traders look to exit:

- Spot Gold is currently up $17.14 or 0.99% at $1754.82

- Spot silver is up $0.28 or 1.14% $25.43

- WTI crude oil futures are trading down $0.04 or -0.07% at $59.79

- Bitcoin is up $1400 or 2.49% of $57,622

In the US stock market, the major indices remain mixed with the Dow down but the S&P and Nasdaq higher. The S&P index reached a new all-time high at 4093.87 today

- S&P index up 11.71 points or 0.29% at 4091.72

- NASDAQ index up 116.8 points or 0.85% at 13805.70

- Dow -23.32 points or -0.07% at 33423

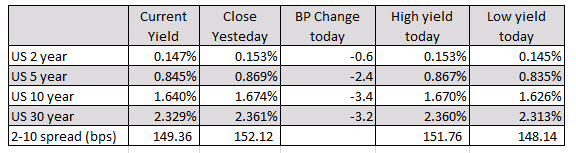

In the US that market yields are lower but off their lowest levels. The U.S. Treasury will auction off three, 10, and 30 year issues next week.

Nikkei 225 closes lower by 0.07% at 29,708.98

A mixed session for Asian equities on the day

Japanese stocks may be plagued by virus fears, with the Topix also seen down 0.8% today, but Asian stocks elsewhere are faring better on the session.

Chinese equities are trading higher, with the Hang Seng up a little over 1% and the Shanghai Composite also marginally higher by 0.4%, mirroring the more positive mood reflected in US futures ahead of European morning trade.

S&P 500 futures are up 0.5%, Nasdaq futures up 0.9%, and Dow futures up 0.3%.

That is setting up a more positive open for Europe as well, with futures trading higher.

Dax has entered a strong period of the year

DAX

There is a general enthusiasm for German stocks despite the recent set back in terms of COVID-19 across the eurozone. Taking a look at the seasonals we have the following data from April 06 – April 30 over the last 10 years. Searchable link here.The DAX has been helped higher by the run up last month in Volkswagen stocks as it makes a move for the electric car market. In fact the rising DAX futures the day after further lockdowns were announced in France was an important affirmation that investors are happy to keep buying German stocks even with an impending third wave of infections.The average gain has been +2.63% and the maximum profit was +7.81% last year. The only year of loss was in 2015 with a drop of -5.52%. The win ratio is 90% and you can see further breakdown here of the max drop during those periods. Aside from the year of loss in 2015 the largest draw down was -3.54% in 2014. So, the pattern is skewed to the upside for the DAX.These stats come courtesy of the team at Seasonax.

Searchable link here.The DAX has been helped higher by the run up last month in Volkswagen stocks as it makes a move for the electric car market. In fact the rising DAX futures the day after further lockdowns were announced in France was an important affirmation that investors are happy to keep buying German stocks even with an impending third wave of infections.The average gain has been +2.63% and the maximum profit was +7.81% last year. The only year of loss was in 2015 with a drop of -5.52%. The win ratio is 90% and you can see further breakdown here of the max drop during those periods. Aside from the year of loss in 2015 the largest draw down was -3.54% in 2014. So, the pattern is skewed to the upside for the DAX.These stats come courtesy of the team at Seasonax.  The only area of concern is further lockdowns across the eurozone. However, it hasn’t held the DAX back so far, so perhaps investors are just content to keep looking to the time when the virus is finally under control. Any return back down to 1460 would offer good value to buyers and provide a key area to define and limit risk. The upside surprise would be if there was a sudden increase in the speed of vaccinations across the eurozone. So, two way risks here along with the strong seasonals.

The only area of concern is further lockdowns across the eurozone. However, it hasn’t held the DAX back so far, so perhaps investors are just content to keep looking to the time when the virus is finally under control. Any return back down to 1460 would offer good value to buyers and provide a key area to define and limit risk. The upside surprise would be if there was a sudden increase in the speed of vaccinations across the eurozone. So, two way risks here along with the strong seasonals.

Searchable link here.The DAX has been helped higher by the run up last month in Volkswagen stocks as it makes a move for the electric car market. In fact the rising DAX futures the day after further lockdowns were announced in France was an important affirmation that investors are happy to keep buying German stocks even with an impending third wave of infections.The average gain has been +2.63% and the maximum profit was +7.81% last year. The only year of loss was in 2015 with a drop of -5.52%. The win ratio is 90% and you can see further breakdown here of the max drop during those periods. Aside from the year of loss in 2015 the largest draw down was -3.54% in 2014. So, the pattern is skewed to the upside for the DAX.These stats come courtesy of the team at Seasonax.

Searchable link here.The DAX has been helped higher by the run up last month in Volkswagen stocks as it makes a move for the electric car market. In fact the rising DAX futures the day after further lockdowns were announced in France was an important affirmation that investors are happy to keep buying German stocks even with an impending third wave of infections.The average gain has been +2.63% and the maximum profit was +7.81% last year. The only year of loss was in 2015 with a drop of -5.52%. The win ratio is 90% and you can see further breakdown here of the max drop during those periods. Aside from the year of loss in 2015 the largest draw down was -3.54% in 2014. So, the pattern is skewed to the upside for the DAX.These stats come courtesy of the team at Seasonax.  The only area of concern is further lockdowns across the eurozone. However, it hasn’t held the DAX back so far, so perhaps investors are just content to keep looking to the time when the virus is finally under control. Any return back down to 1460 would offer good value to buyers and provide a key area to define and limit risk. The upside surprise would be if there was a sudden increase in the speed of vaccinations across the eurozone. So, two way risks here along with the strong seasonals.

The only area of concern is further lockdowns across the eurozone. However, it hasn’t held the DAX back so far, so perhaps investors are just content to keep looking to the time when the virus is finally under control. Any return back down to 1460 would offer good value to buyers and provide a key area to define and limit risk. The upside surprise would be if there was a sudden increase in the speed of vaccinations across the eurozone. So, two way risks here along with the strong seasonals.Eurostoxx futures +0.7% in early European trading

Some catch up play for Europe going into the open

- German DAX futures +1.1%

- UK FTSE futures +0.6%

- Spanish IBEX futures +0.6%

After the more upbeat mood in US equities yesterday, European indices have some catching up to do following the Easter break since last Friday.

The early gains belie the more measured risk mood so far today though, with US futures pulling back slightly after yesterday’s stellar advance. S&P 500 futures and Dow futures are down 0.2% while Nasdaq futures are keeping flatter with Treasury yields a touch lower.

That is keeping the dollar steadier and major currencies little changed so far on the day.

Nikkei 225 closes lower by 1.30% at 29,696.63

A bit of a pullback in Asian equities today

The Nikkei clipped the 30,000 mark for the first time in just over two weeks yesterday but failed to hang on above that as a stronger yen from overnight trading, among other factors, weighed on the index. The Topix also closed 1.5% lower on the day.

Elsewhere, Chinese equities are still struggling somewhat with the Shanghai Composite down 0.2% despite more upbeat PMI data from earlier. That said, better economic prospects may prove to be a double-edged sword as it reaffirms fears of policy tightening

Global Indices : FTSE100 ,CAC ,DAX #NIKKEI #ShanghaiComposite #Hangseng #Bovespa #RTSI #KSE100 #KOSPI -#AnirudhSethi

![What are the GLOBAL INDICES to see before taking a trade [HINDI]? - YouTube](https://i.ytimg.com/vi/7FqMmIuAbMI/maxresdefault.jpg)

To read more enter password and Unlock more engaging content