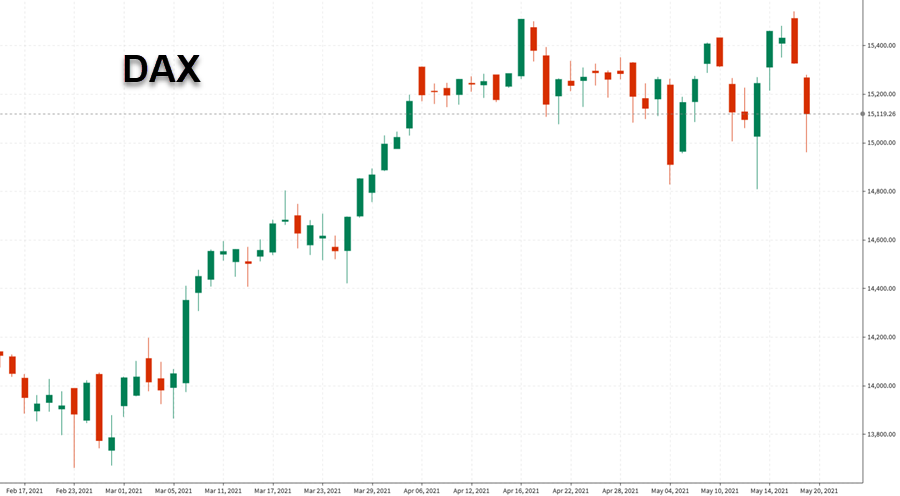

German DAX up marginally. Francis CAC and UK FTSE 100 down marginally

The European shares are ending the day with mixed results. The provisional closes are showing:

- German DAX, +0.2%

- France’s CAC, -0.2%

- UK FTSE 100, -0.2%

- Spain’s Ibex, +0.2%

- Italy’s FTSE MIB, +0.15%

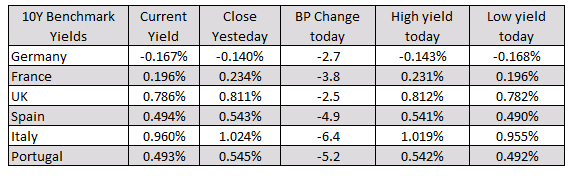

In the European debt market, the benchmark 10 year yields are all trading to the downside. Italy is leading the way with a decline -6.4 basis points. France’s 10 year is down – -3.8 basis points.

In the forex, the snapshot of the market currently shows the EUR as the strongest, while the GBP is the weakest. The USD has gained in the NY session and trades near NY session highs vs the EUR, GBP, CHF, CAD, AUD and NZD.

In the forex, the snapshot of the market currently shows the EUR as the strongest, while the GBP is the weakest. The USD has gained in the NY session and trades near NY session highs vs the EUR, GBP, CHF, CAD, AUD and NZD.

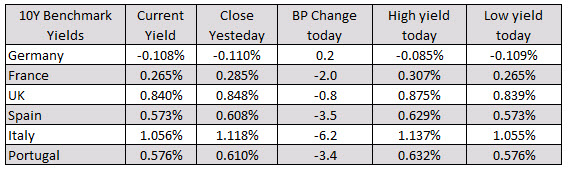

In the European debt market benchmark 10 year yields were also lower with the exception of a small 0.2 basis point gain in Germany.

In the European debt market benchmark 10 year yields were also lower with the exception of a small 0.2 basis point gain in Germany.