German DAX +1.0%

The major European indices posted gains to start the trading week. The provisional closes are showing:

- German DAX, +1.0%

- France’s CAC, +0.5%

- UK’s FTSE 100, +0.6%

- Spain’s Ibex, +0.15%

- Italy’s FTSE MIB, +0.6%

The major European indices posted gains to start the trading week. The provisional closes are showing:

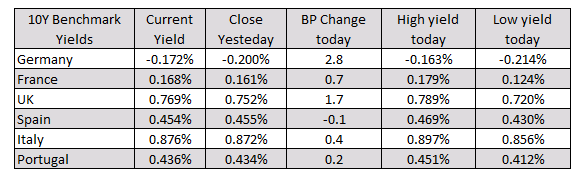

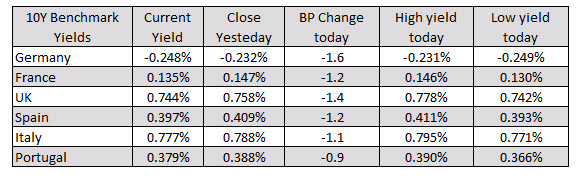

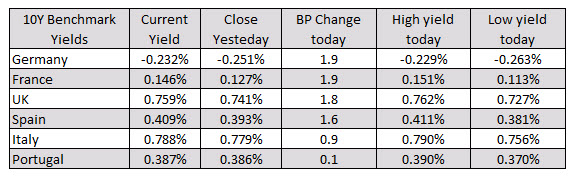

In the European equity market, the benchmark 10 year yields are mixed with flight to safety flows into the German, France, UK debt (yields lower), and flights out of risk in the Spain, Italy, and Portugal notes (yields higher):

The major European indices are closing mixed with modest changes. The snapshot of provisional closes shows:

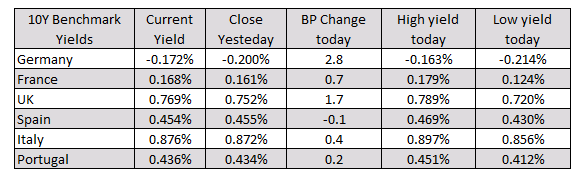

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:The major European indices are ending the session with mixed results. Spain and Italy tilt more to the downside.

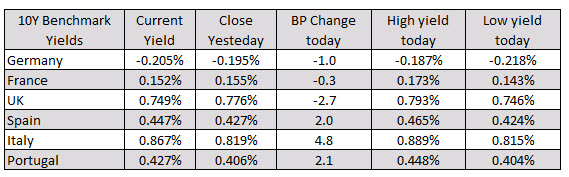

In other markets as European/London traders look to exit:

In other markets as European/London traders look to exit:

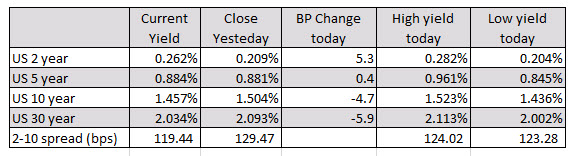

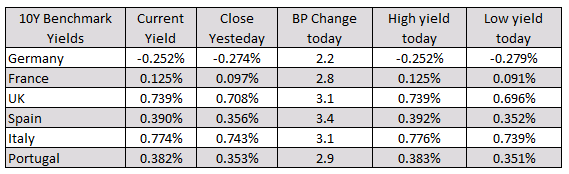

The benchmark 10 year yields in Europe are also higher with Spain 10 year up 3.4 basis points leading the way:

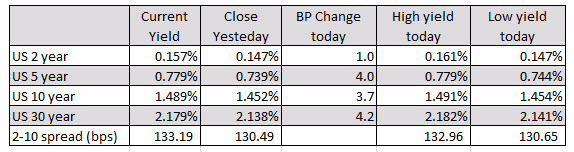

The major market indices are closing higher with the S&P posting a record close. The gains were led by the NASDAQ stocks. The Dow lagged but still closed positive on the day.