Archives of “Global Indices” category

rssEuropean shares erase earlier declines. Close higher on the day/down for the week.

Major indices close higher.

The major European indices have erased earlier declines and are closing higher today. The provisional closes are showing:

- German DAX, +0.2%. The index was down -0.71% at the lows

- France’s CAC, +0.3%. The index was down -0.57% the lows

- UK’s FTSE 100, +0.4%. The index was down -0.39% at the lows

- Spain’s Ibex, +0.2%. The index was down -0.58% at the lows

- Italy’s FTSE MIB, unchanged. The index was down -0.86% at the lows

for the week:

- German DAX, -1.2%

- France’s CAC, -4.0%

- UK’s FTSE 100 -1.85%

- Spain’s Ibex -0.7%

- Italy’s FTSE MIB -2.8%

In other markets as London/European traders look to exit for the week:

- Spot gold is up $4.30 or 0.24% at $1783.76.

- Spot silver is down eight cents or -0.32% $23.11

- WTI crude oil futures are down $0.64 or -1% at $62.98

- The price of bitcoin is up near $1700 at $48,455

In the US stock market, the major indices have also reversed earlier declines.

- Dow industrial average is trading up 194 points or 0.56% at 35088.46. It traded as low as -27.05 points

- S&P index is up 12.4 points or 0.28% at 4431.04

- NASDAQ index is up 113 points or 0.78% 14654.33

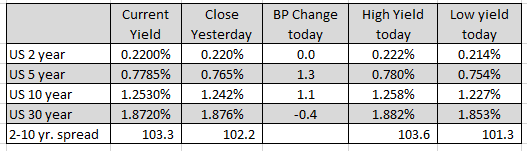

In the US debt market, the yields are mostly higher with the 30 year still modestly lower.

In the European debt market, the benchmark 10 year yields are unchanged to modestly higher:

Japan’s Nikkei 225 index falls to fresh lows for the year

There are quite a number of worrying charts for risk at the moment

And the Nikkei’s latest drop adds to that, with the index slipping to its weakest levels since late December. While equities in Europe and US have been holding up for most of the year, Japanese stocks have struggled since the BOJ revamped its ETF guidance.

The central bank’s move while does not explicitly removes support for equities, they surely have not shown the same kind of conviction to support the stock market as they did amid the pandemic last year – so that does say something.

Elsewhere in Asia, it’s another meltdown for Chinese equities with the Hang Seng down by 2.5% and Shanghai Composite also down by 2.0% on the day.

European major indices close the day with mixed results

UK’s FTSE 100 and France’s CAC move lower

The major European indices are closing the day with mixed results. The UK FTSE 100 and the France’s CAC moved lower while the German, Italian and Spanish indices all closed higher:

- German DAX, +0.3%

- France’s CAC, -0.7%

- UK’s FTSE 100, -0.3%

- Spain’s Ibex +1.1%

- Italy’s FTSE MIB +0.5%

in other markets as European traders look to exit:

- Spot gold is trading down $4.64 or -0.26% at $1781.25

- Spot Silver is trading down $0.25 or -1.05% at $23.39

- WTI crude oil futures are down $0.28 or -0.42% at $66.27

- Bitcoin is trading up $700 and $45,393

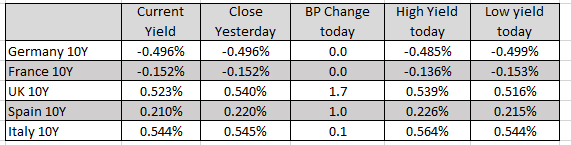

in the US debt market, the yields are higher ahead of the 20 year auction at 1 PM ET. The 10 yield is up 2.2 basis point on the day while the 30 year is up 1.1 basis point.

European shares close mostly lower. UK FTSE 100 an exception

German Dax down for the second consecutive day

The European shares are closing mostly lower. the one exception is the UK FTSE 100 which is closing up marginally.

The provisional closes are showing:

- German DAX, -0.1%

- France’s CAC, -0.3%

- UK’s FTSE 100, +0.3%

- Spain’s Ibex, -0.65%

- Italy’s FTSE MIB, -0.8%

Looking at other markets as London/European traders look to exit:

- Spot gold is trading down five dollars or -0.28% at $1782.

- Spot silver is trading down $0.20 or -0.86% at $23.63

- WTI crude oil is trading up $0.19 or 0.28% at $67.58

- The price of bitcoin is trading down 100 dollars at $45,830

In the US stock market, the major indices are all trading lower with the NASDAQ index had the hardest:

- Dow -261 points or -0.73% at 35363

- S&P index -28.63 points or -0.64% at 4451.24

- NASDAQ index -140 points or -0.95% at 14652.94

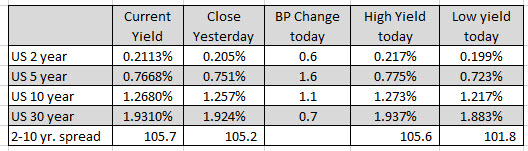

In the US debt market, yields are higher after starting the New York session negative. The 10 year yield is currently trading at 1.268% (up 1.1 basis point).

Euro Stoxx index falls for the first time in 11 trading sessions

European indices move lower today

The major European indices have closed lower today.

- The Euro Stoxx index fell for the first time in 11 trading sessions (10 higher closes).

- The German Dax came off of a record levels.

- The France’s CAC could not reach its all-time high from 2000

A look at the provisional closes shows:

- German DAX, -0.5%

- France’s CAC, -0.9%

- UK’s FTSE 100, -1.0%

- Spain’s Ibex, -0.83%

- Italy’s FTSE MIB, -0.85%

The Euro Stoxx index fell -0.7%.

In other markets as London/European traders look to exit:

- Spot gold plus $5.50 or 0.32% at $1784.85.

- Spot silver is up for cents or 0.21% $23.75

- WTI crude oil futures are down $0.35 or -0.49% at $67.60

- bitcoin is trading down $773 at $46,248. The digital currency traded above $48,000 today

In the US stock market, the major indices are lower but off their lowest levels:

- Dow is down -79 points or -0.22% at 35436

- S&P index is down -16.29 points or -0.36% at 4451.53

- NASDAQ is down 125 points -0.85% 14697.65

In the forex market, the CHF is now the strongest of the majors while the CAD remains the weakest. The USD is mixed with gains vs the CAD, AUD and NZD and declines vs the JPY and CHF. The greenback is near unchanged levels vs the EUR and GBP.

European equities weighed down to start the day

A softer start to the session

- Eurostoxx -0.6%

- Germany DAX -0.6%

- France CAC 40 -0.7%

- UK FTSE -0.7%

- Spain IBEX -0.9%

- Italy FTSE MIB -0.6%

Risk stays on the retreat as the market sticks with a more defensive tone for the time being. US futures are also keeping lower, with S&P 500 futures down 0.3%, Nasdaq futures down 0.2%, and Dow futures marked down 0.4% on the day.

The Euro Stoxx index holds on for the 10th straight day of gains

German Dax new record high. France’s CAD works closer to the 2000 high

The Euro Stoxx index is holding onto a small gain, making it 10 straight higher closes for that index. The German Dax moved higher and closed at another record. The France’s CAC moved higher and got closer to the September 2000 all time high.

The provisional closes are showing:

- German DAX, +0.3%.

- France’s CAC, +0.2%

- UK FTSE 100, +0.4%

- Spain’s Ibex, +0.2%

- Italy’s FTSE MIB, +0.3%

For the week, the major indices are all up on the week:

- German DAX, +1.4%

- France’s CAC, +1.1%

- UK’s FTSE 100 +1.3%

- Spain’s Ibex +1.3%

- Italy’s FTSE MIB, +2.5%

As mentioned the Euro Stoxx index has moved higher for 10 consecutive days. That is a record streak. The gain has been around 3.3% over that two week period. It trades at a all time high.

BlackRock on US equities – turn neutral (& upgrade European equities to overweight)

ArticleBody BlackRock is the world’s largest asset manager, circa $9 trillion in assets under management (as of June 2021).

Some snippets from their latest on US and Euro equities.

- We turn neutral U.S. equities. We see U.S. growth momentum peaking and expect other regions to be attractive ways to play the next leg of the restart as it broadens to other regions, notably Europe and Japan.

- We upgrade European equities to overweight on the back of the broadening restart. We see a sizeable pickup in activity helped by accelerating vaccinations. Valuations remain attractive relative to history and investor inflows into the region are only just starting to pick up.

Major European indices close higher. German DAX closes at a new record high.

France’s CAC continues to move toward its all-time high price from 2000

The major European indices are closing higher. The German Dax closed at a new all-time high. The France’s CAC also closed at a 2021 new high and works closer to its 2000 all time high.

The provisional closes are showing:

- German DAX, +0.3%

- France’s CAC, +0.5%

- UK’s FTSE 100, +0.8%

- Spain’s Ibex, +0.9%

- Italy’s FTSE MIB, +1.0%

In other markets as European traders look to exit:

- Spot gold is trading up $20.20 or 1.17% at $1749.29.

- Spot silver is up $0.16 or 0.69% $23.49

- WTI crude oil futures are trading down $0.79 or -1.16% at $67.66

- Bitcoin is trading up $1000 at $46,637

In the US stock market, the Dow and S&P traded to a new all-time highs and remain on track for a record close today. The NASDAQ index continues its slide as investors rotate out of the big cap tech into cyclicals.

- Dow, up 164 points or 0.47% at 35429

- S&P up 2.55 points or 0.06% at 4440

- NASDAQ index down 68 points or -0.46% at 14719

In the forex, the NZD and the AUD are the strongest of the majors, while the USD and CAD are the weakest. The USD has corrected lower today after the recent run to the upside. Although CPI inflation came in more or less as expected, the market is hopeful that the peak is in place (time will tell). The fall in the dollar may also be attributed to a technical correction after some key targets were reached.