Gains of over 1% seen in the European equity markets today

The European major indices are ending the session with solid gains of 1% or more. The provisional closes are showing:

- German DAX, +1.05%. That was the best session in two weeks.

- France’s CAC, +1.5%

- UK’s FTSE 100 +1%

- Spain’s ibex +1.5%

- Italy’s FTSE MIB, +1.8%

In other markets as European traders look to exit for the day:

- Spot gold down $9.28 or -0.52% at $1760.43

- Spot silver down $0.10 or -0.48% $22.58

- Crude oil futures up $1.78 or 2.32% at $79.40

- Bitcoin is trading right around the $50,000 level at $49,990

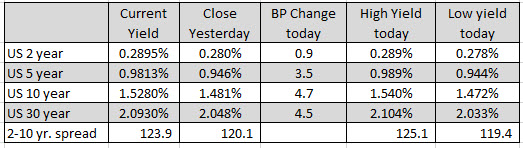

In the US debt market, the tenure yield has come off the basis point or so from its high level of 1.540%. It currently trades at 1.528%. Other yields are also higher with a steeper yield curve.

The USD has seen some selling in the last hour of trading as European traders had for the exits. The USD is trading more mixed after being higher earlier in the US session. The greenback is higher verse the EUR, JPY, CHF and lower vs the GBP, CAD, AUD and NZD.