Closing changes from the main bourses:

- UK FTSE 100 +0.3%

- German DAX -0.3%

- French CAC +0.1%

- Spain IBEX -0.4%

- Italy MIB +0.7%

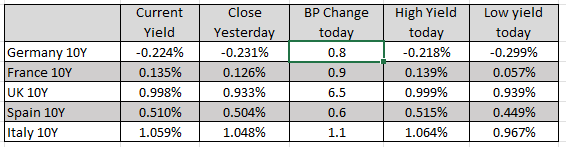

The major European indices are ending the session today with mixed results. PMI flash estimates were stronger than expected. Yields moved higher. UK FTSE and Spain’s Ibex moved higher. Other indices are lower on the day.

Changes for the week are mixed

Changes for the week are mixedThe major European indices are closing the day lower led by declines in the Spain’s Ibex and Italy’s FTSE MIB. The move to the downside were triggered by fears of the Covid resurgence. Austria announced that they would lockdown starting Monday and require vaccinations. Other levels of resurgence in Covid cases are happening on the continent,, boosting fears of an economic slowdown.

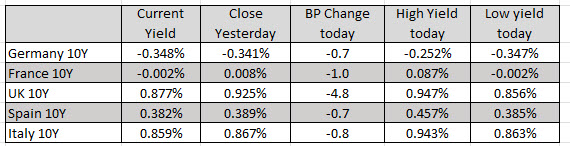

In the European debt market, the 10 year yields are lower with the UK yields down the most at -4.8 point basis points.

In the European debt market, the 10 year yields are lower with the UK yields down the most at -4.8 point basis points.

The German index has now been up for five consecutive days. It reached a new all-time intraday high of 16266.26 today. Since October 6, the index is up 9.64%