Moving averages broken on the run lower today

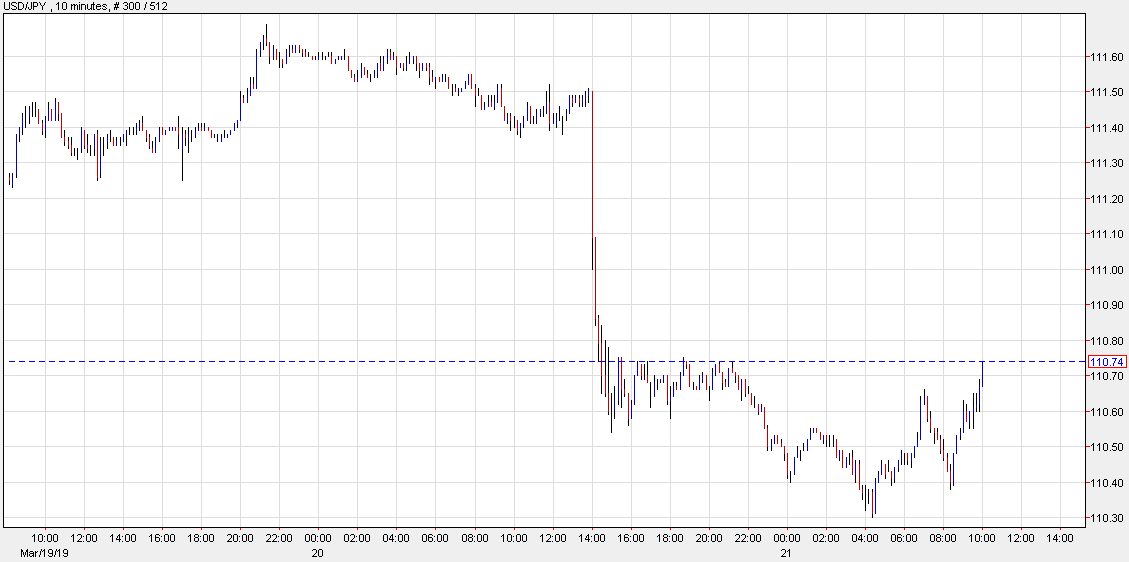

The PMI data out of the EU were much weaker than expexted and the EURUSD raced lower. Looking at the 1 minute chart below, the pair raced below the 100 hour and 100 day MA and the 200 hour MA in the first minute after the report (the run was about 43 pips in the first minute). The fall continued for another 40 pips over the 30 minutes or so to the low of 1.1287. Total move was about 83 pips. Since that low, the pair has had higher lows at 1.1292-94. A move below that intraday floor would be more bearish intraday. The corrective high has reached 1.1319 – that is below the 38.2% of the trend move down (at 1.13266). Sellers are still in control.

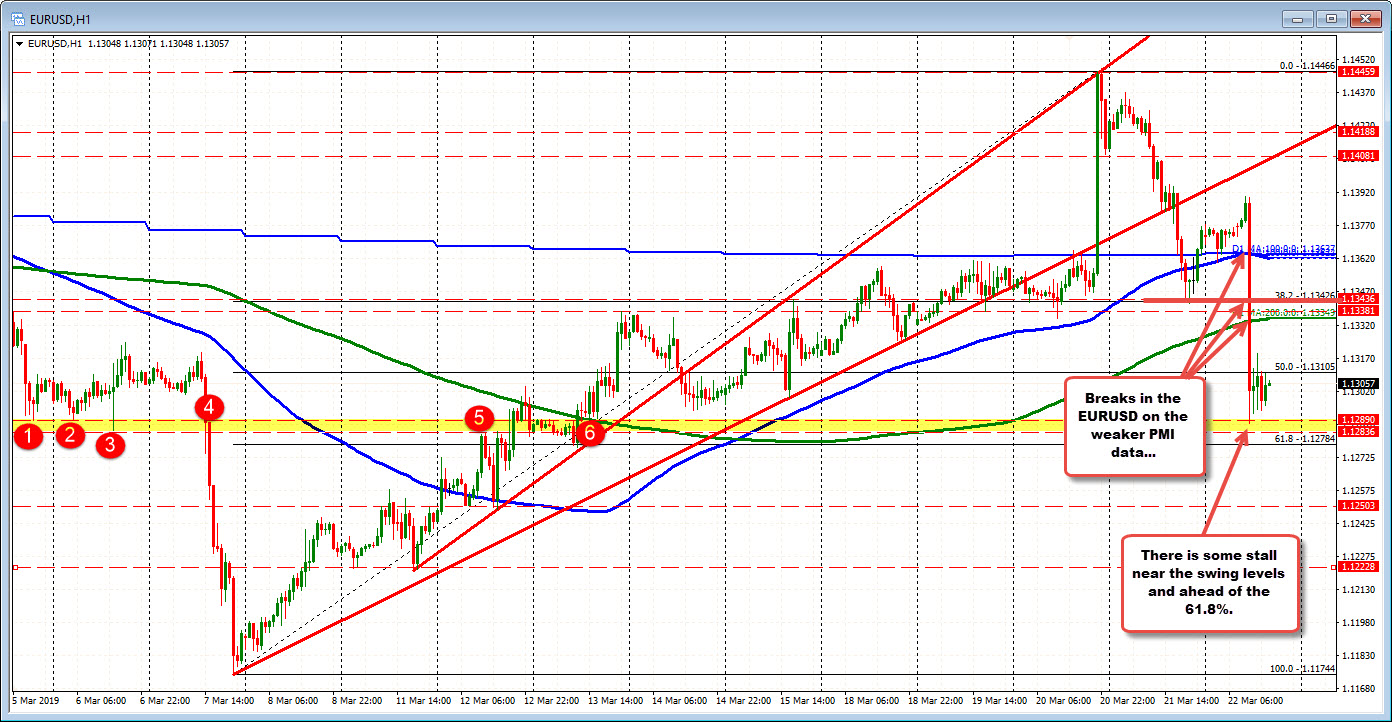

Looking at the hourly chart below, the pairs steep fall has also taken the price below the 50% midpoint of the move up from the March low. That comes in at 1.13105. The corrective high has moved above that level, but the last two bars are trying to put a lid near that level.

On the downside, the low today did stall in an area defined by swing levels (at 1.12836-89). The 61.8% is at 1.12784. Those are the next targets on more weakness today. Get below opens up the downside even more.

The data today was shocking and it is reflective in the price action. There is some minor support and traders are taking a breather over the last 5 or so hours. However, the corrective highs have been modest so far. It owuld take a move above the 38.2% of the move down at 1.13266 to likely put a little scare in intraday shorts, but a move above the 200 hour MA at 1.1335 currently (green line in the chart above), to really put some fear in the shorts.