Forex Update : #RUPEEINDEX #USDINR #USDJPY #EURUSD #USDCHF #USDCAD #AUDUSD #NZDUSD –#AnirudhSethi

/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

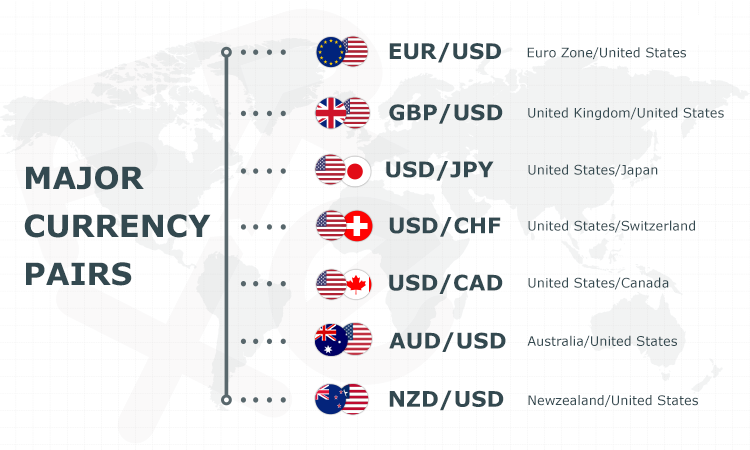

The US dollar remains on the defensive in the unwind from the Fed trade.

It’s tough to pin down what’s behind the euro rally. Earlier in the week, you could pin it on hopes for a ceasefire in Ukraine and stability in sanctions but with Russia cooling those hopes for today (leading to the rally in oil and gold) that’s a tough sell today.

In the technical picture, it’s all consolidation so long as we stay below 1.1121 and that might be a good level to sell against on a low-risk trade if the momentum stops after the fix.

The only thing I can see on the fundamental side is compression between the US and Europe. ECB policymakers are staying dovish (though Knot today showed some flexibility). I find it tough to believe the US will continue to tighten above neutral while the ECB is able to stay close to zero with its inflation-only mandate. That’s particularly true with the energy pressure on Europe and more of an appetite for green investment/carbon taxes.

At the same time, all that might be balanced by a deteriorating growth outlook.

The ECB needed to do a couple of things in this meeting and they pretty much nailed it by offering some commitment to end bond purchases in Q3 this year.

In doing so, they offer up themselves some flexibility (the caveat being that they could change the schedule depending on the data and outlook) but it also gives the market a rough idea of when rate hikes could follow after. Adding to that, considering that rate hike bets were pared back in the past week, the euro is also getting a lift so they are able to stay away from any direct verbal intervention.

Two birds with one stone.

The euro is now up and above 1.1100 against the dollar currently but we’ll see if that can hold into the daily close.

That could open the path towards testing the 50.0 retracement level @ 1.1150 next. Lagarde’s press conference is up next and I would expect that to add more colour to the statement, so we’ll see how that goes.