Weekly forex futures net non-commercial positioning data for the week ending May 7, 2019:

- EUR short 106K vs 105K short last week. Unchanged

- GBP short 7K vs 5K short last week. Shorts increased by 3K

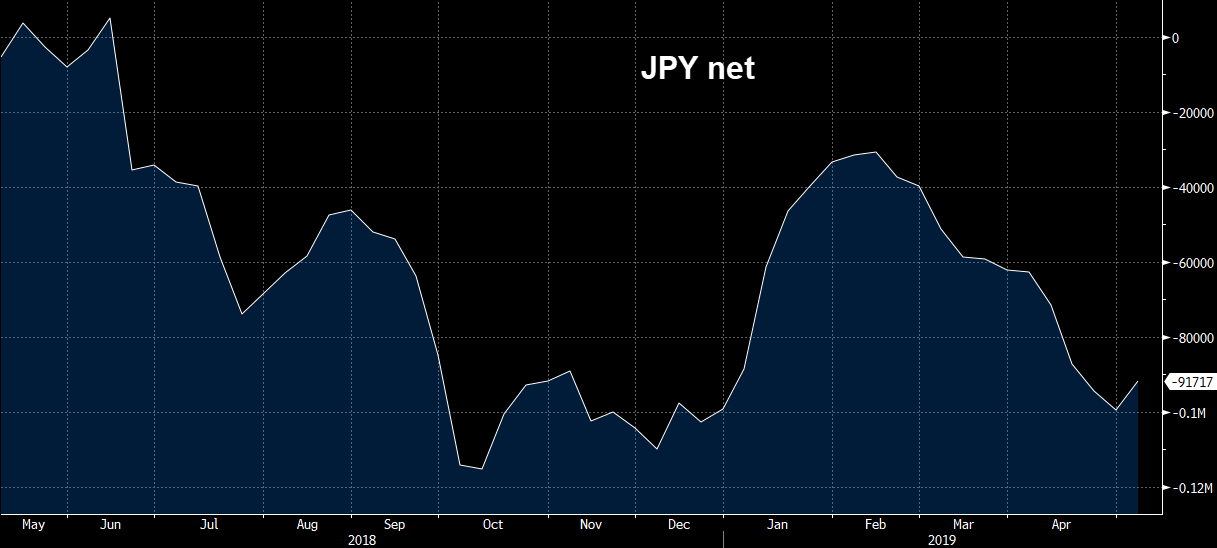

- JPY short 92K vs 100K short last week. Shorts increased by 6K

- CHF short 40k vs 40k short last week. Shorts increased by 2K

- AUD short 57k vs 59k short last week. Shorts increased by 9K

- NZD short 13K vs 11K short last week. Shorts increased by 6K

- CAD short 46K vs 47K short last week. Unchanged

- Prior report

There were no big themes developing in the latest report. The US dollar remains a heavy favourite of specs and it’s as crowded as ever. The net euro position is the most extreme since Dec 2016.