Archives of “Forex” category

rssMnuchin says in ‘serious’ talks with China to improve trade ties

Comments from the Treasury Secretary in Senate hearing

- China recently retreated on many trade commitments

- Mnuchin says he will likely go to Beijing at some point to continue talks

Sterling touches lowest since February as Brexit uncertainty drags on

The pound brushed its lowest level since mid-February as the UK currency tracked a deepening sense among investors that Westminster’s cross-party talks seeking a consensus on a Brexit agreement were faltering.

At the same time, a move away from risk across global markets left sterling looking exposed, and sent it towards the lower end of its trading range.

Sterling on Wednesday fell 0.5 per cent to trade at $1.2838 in afternoon trading in London, close to its lowest level since February 15. February’s intraday low was $1.2770.

As talks between Theresa May and the opposition leader in London flag, the prime minister challenged Jeremy Corbyn to make up his mind on whether to back her Brexit compromise plan. She meanwhile prepared to put her job on the line in a House of Commons vote in the first week of June.

Mrs May told the Labour leader the government would bring forward legislation to ratify a revised Brexit deal on June 4 or 5. Defeat would probably mean the end of the road for the prime minister and her attempt to take Britain out of the EU.

In talks lasting about an hour on Tuesday night, Mrs May said the government would propose a close customs arrangement with the EU and uphold workers’ rights and environmental protections, meeting some of Labour’s demands.

Pakistan’s currency in line for further hits after IMF loan

Pakistan’s opposition parties have promised to resist the country’s upcoming $6 billion loan agreement with the International Monetary Fund, terming the deal a sellout on the part of Prime Minister Imran Khan’s government.

An initial agreement, announced late on Sunday, has Pakistanis angry for two main reasons: It calls on them to start paying their income taxes and sets the stage for their money to lose more of its value.

On Monday, Ahsan Iqbal, a senior leader of the opposition Pakistan Muslim League-Nawaz, told the Nikkei Asian Review that the agreement “is a complete capitulation [and in disregard to] Pakistan’s national interests. Never before in our history have we seen a government accept such tough conditions tied to an IMF program.”

Iqbal’s sentiment is widely shared among opposition leaders. After Reza Baqir, a former IMF official and a well-respected economist, early this month was appointed governor of Pakistan’s central bank, opposition leaders rejected the nomination. Iqbal said Baqir’s appointment only confirms that Pakistan has become “a colony of the IMF.”

He added, “You now have an IMF man running our central bank.” (more…)

EURUSD catches a reversal cold. Fixing takes the pair lower?

What we do know is the ceiling stalled the rally, and the bullish control weakened

The EURUSD is trading higher with the lower dollar flows

Trade wars heats up

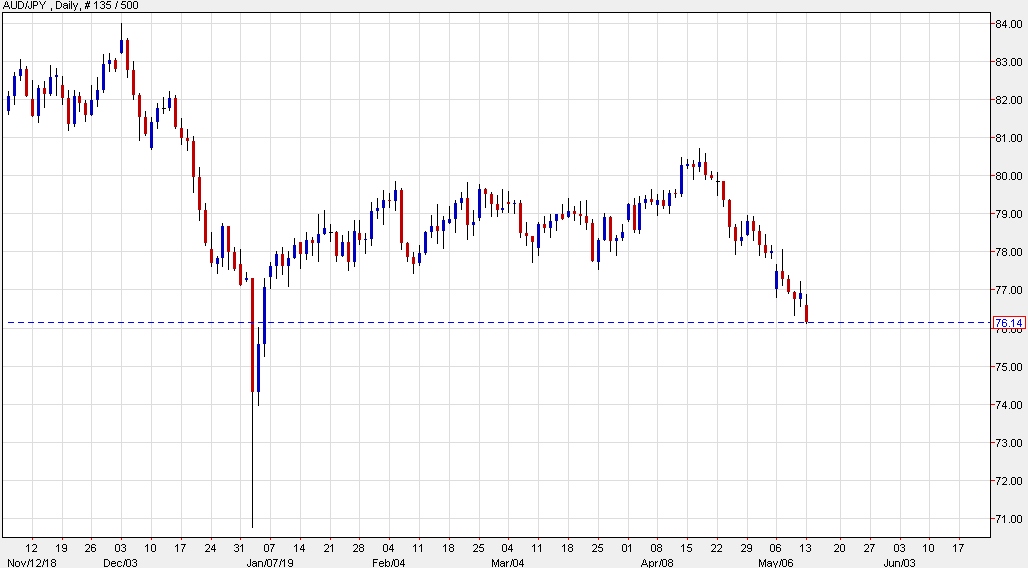

AUD/JPY falls to the lowest since the January 3 flash crash on trade war fears

AUD/JPY down more than 1%

Technically, there isn’t a lot to prevent this pair from sinking all the way back down to the January low. There is some scope for Australian firms to take Chinese market share away from the US but softer global growth will be a huge headwind if this trade battle continues.

LIBOR 3 Month :Eyes on 2.533 !!

Three consecutive close below 2.533 +weekly close will take to 2.4375-2.40

More to our Members.

Crucial Update :Dollar Index ,Euro ,GBP ,YEN ,INR ,CAD ,AUD ,SPX500 ,Nasdaq Composite ,Brent -WTI Crude -ANIRUDH SETHI

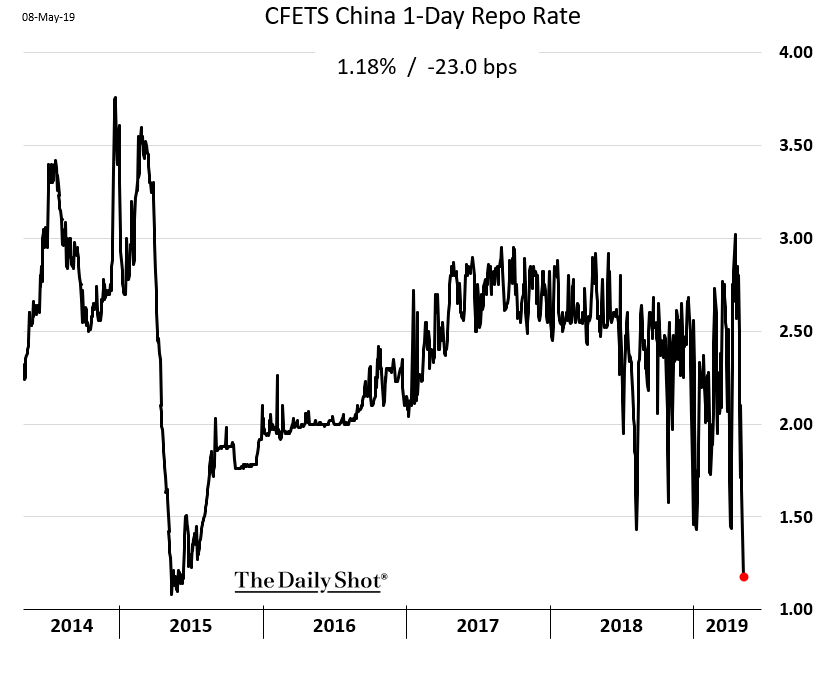

The PBoC lets the 1-day repo rate drop to the lowest level since 2015 in preparation for the trade war escalation