The tariff truce came to an abrupt end via presidential tweets on May 3. Until those tweets, US officials had been indicating that progress was being made and there was hope that at the sidelines of the G20 meeting that Trump and Xi would agree on a trade deal. The end of the tariff truce marked a turning point in the markets. Risk appetites were reduced. Equities and yields fell. The dollar eased in the first half of May as renewed trade tensions were understood as increasing the likelihood that the Federal Reserve would cut interest rates. The greenback recovered in the second half of the month, with the notable exceptions of the Japanese yen and Swiss franc, as the still wide interest rate differentials and idea that the US is best prepared to weather escalating trade conflict.

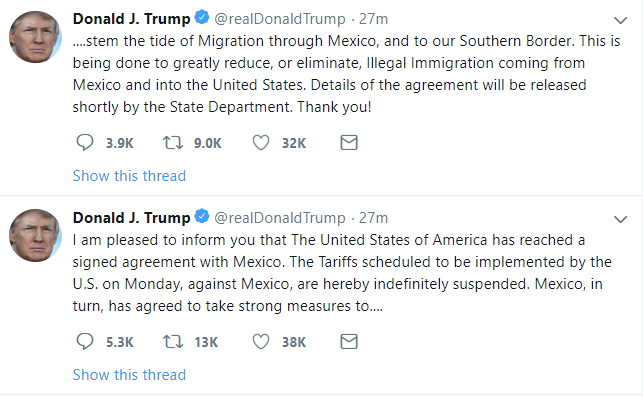

Ahead of the imposition of China’s retaliatory tariffs on June 1 and as just as the process seeking ratification of the new North American free-trade agreement has begun, President Trump surprised the world by claimed emergency powers and imposed a 5% tariff (effective June 10) that could gradually rise to 25% at the start of Q4 unless Mexico tightens up its border controls. There are likely to be far-reaching even if unintended consequences for Mexico, the outlook for monetary policy and as an alternative for those seeking to move facilities from China, and the US economy and future trade negotiation. The current trajectory would put a 25% tariff on all the goods from the two countries that are the largest source of US imports, and a 25% tariff on all car imports. Shades of Smoot-Hawley.

The local elections proved disastrous for the UK Tories at the beginning of the month, and their performance in the EU Parliament elections was not better. Prime Minister May finally succumbed to pressure, resigning before the results of the EU Parliament elections were announced. The risk-off environment that followed the end of the tariff truce plus the heightened risks that May’s successor would increase the risk of a no-deal exit weighed sterling. Sterling fell nearly six cents over the course of the month and fell almost every day against the euro after Trump’s twitter storm on May 5.

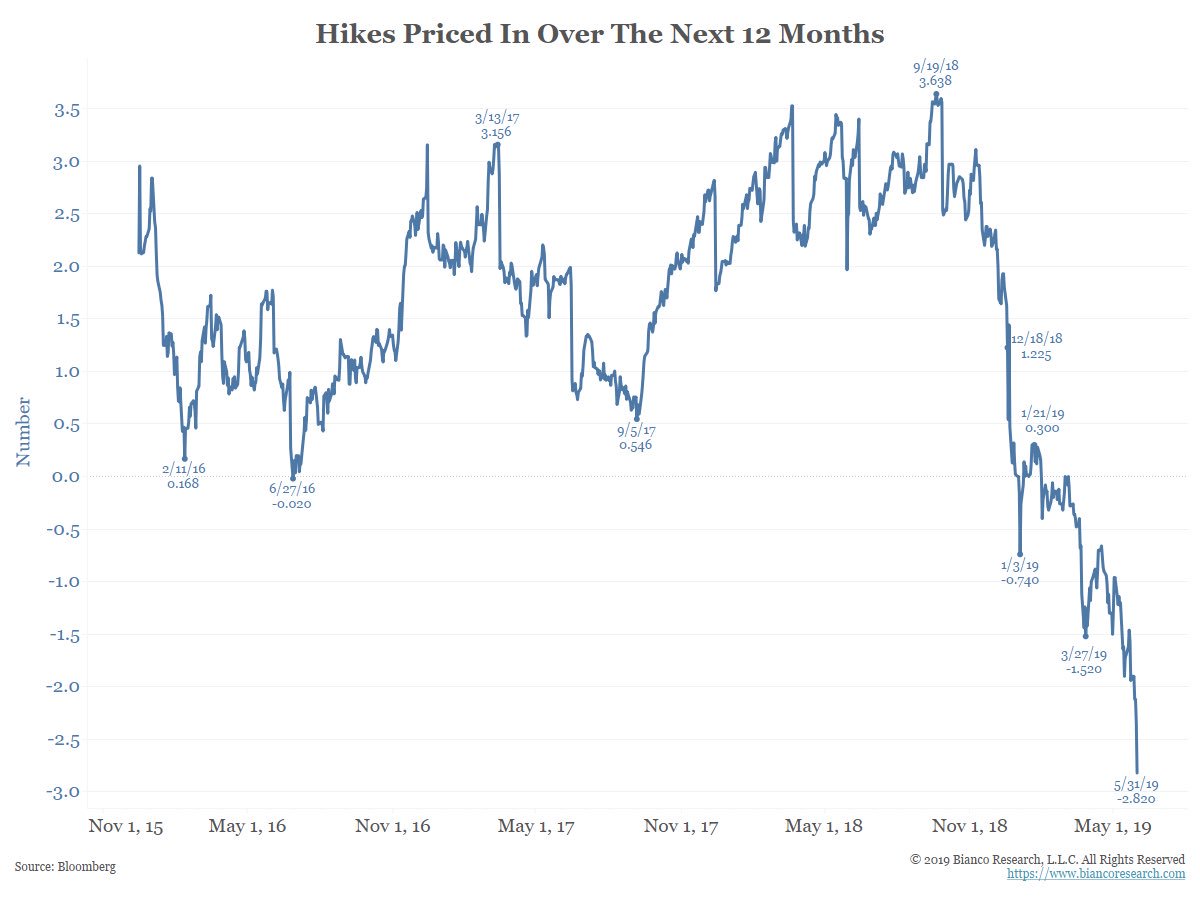

The June ECB (June 6) and Federal Reserve (June 19) meetings are among the month’s highlights. Although neither central bank is expected to announce new initiatives, both with present updated forecasts The ECB will also provide some more details of its new Targeted Long-Term Refinancing Operation (TLTRO). Meanwhile, the gap between the Fed’s declaratory policy (patience, wait-and-see) and the market, which is aggressively pricing in a rate cut before the end of the year, has rarely been more stark.

The Chinese yuan’s 2.6% decline against the dollar in May unwound the lion’s share of its gains for the year. The fall, however, is not a reflection of officials seeking to offset the tariff effects. In word and deed, Chinese officials have been tempering the yuan’s decline and warning against speculators. Owing to interdependency and limited alternatives, we argue that it is difficult for China to use the yuan’s exchange rate, its holdings of US Treasuries, or its dominance in rare earth minerals to use as leverage against the US. Due to the costs involved, we identify them as possible measures at a much higher level of the escalation ladder.

To read more enter password and Unlock more engaging content