Trump had indicated concern on a weak yen, but this issue not raised in talks with Abe

ANZ Research discusses EUR/USD outlook and adopts a bearish bias over the medium-term.

“Sell EUR rallies as EA disinflation pressures grow. The ECB is clear that its policy options are not limited, but the persistence of negative interest rates does imply constraints. Whilst the US FOMC indicated it will cut interest rates to underpin the expansion if necessary, our assessment is that disinflation risks in the euro area are much greater,” ANZ notes.

“The bund yield is at record lows, measures of inflation expectations have also made record lows recently and confidence that inflation will reach the ECB’s target is fading. The factors underpinning euro area weakness are, to a large extent, external to monetary policy. They include trade tensions, auto industry difficulties, climate change targets and lingering fiscal risks. It is reasonable to argue that inflation expectations could converge on core inflation. Monetary conditions must therefore stay extremely accommodative.

We look for a test below 1.10 in EUR/USD in coming months,” ANZ adds.

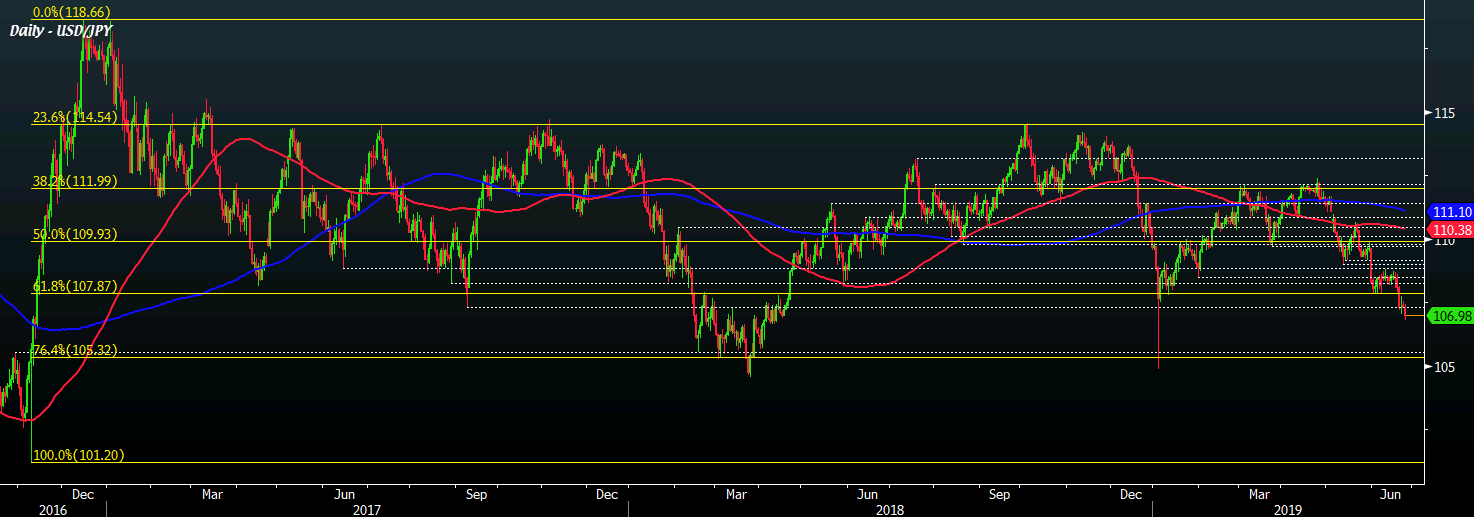

According to the firm’s senior Asian FX strategist, Ken Cheung, they expect USD/JPY to extend its fall towards 104.00 amid dollar strength peaking out while haven demand will help to boost the yen’s allure by the end of this year.

“We expect USD peaking out as rate cut cycle and heightening uncertainties over global recession risk and US-China trade war push safe havens like JPY higher. While the unwinding of long USD positioning before the Fed’s rate cut cycle continued to weigh on the dollar, heightening safe haven demand on JPY given G20 uncertainties and increasing geopolitical tensions in Iran sent USD/JPY below the 107.00 handle.”