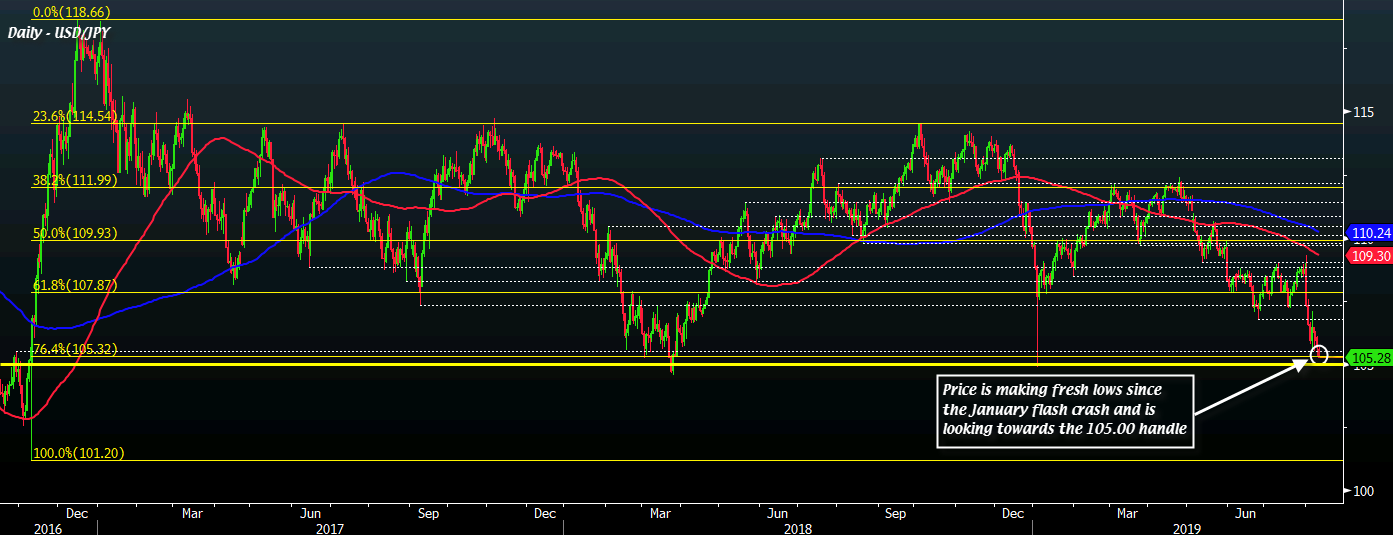

USD/JPY falls to 105.24, the lowest level since the January flash crash

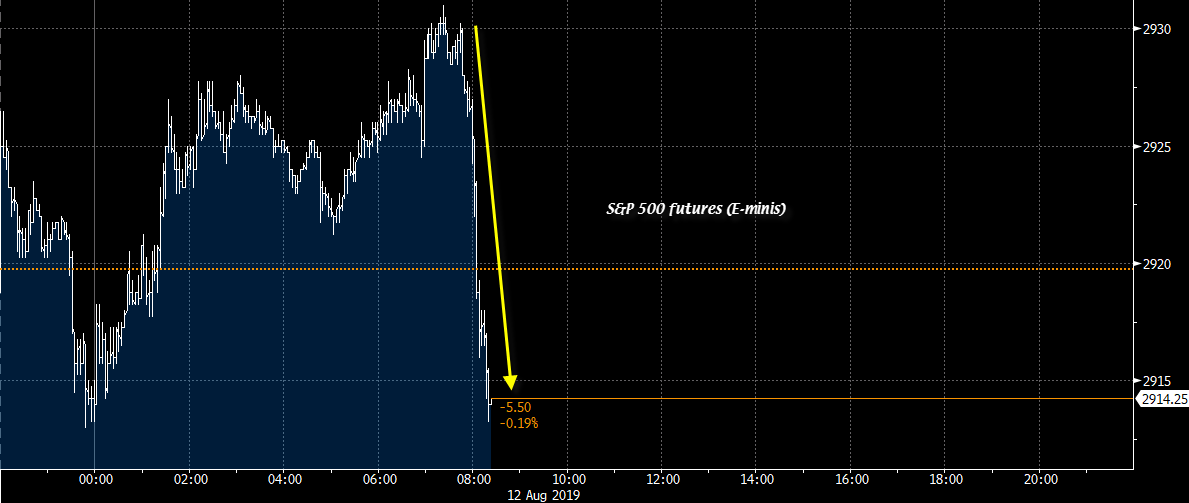

Equities are hitting session lows on the day with European equities having nearly pared all of their earlier gains and US futures now trading in negative territory on the session.

This comes amid a fresh wave of risk aversion sweeping across markets and is also helping to push Treasury yields lower. 10-year yields are down by 4.5 bps to 1.70% currently and that is seeing USD/JPY be pushed to fresh lows since the January flash crash.

As

highlighted earlier, the 105.00 handle will be a key spot to watch in the near-term for USD/JPY amid ongoing cautious sentiment in markets.

Large expiries and notable bids should allow the figure level to hold up but as long as markets remain petrified by ongoing US-China trade tensions and a slowing global economy, it is but a speed bump in the road for sellers to drive the pair lower.

If price starts to break down below that, expect stops to be triggered and things could get real ugly for risk sentiment when that happens. At the same time, expect Japanese officials to chime in again with more commentary as we saw last week.