An Update : #USDOLLARINDEX #EUROINDEX #EURUSD #USDJPY #USDINR #EURINR #AUDUSD ► #AnirudhSethi

The monetary policy divergence between the Bank of Japan and, well, pretty much everyone else, has been stark. And that does not look set to change any time soon. While there have been pullbacks (nothing moves in a straight line) the drivers of yen weakness have remained in place and the yen has kept on sliding.

–

more to come

Japan was unlikely to intervene in the FX market to stop it from sliding, 45% of 22 poll respondents said.

Ten of 22 poll respondents said Japan would not intervene.

—

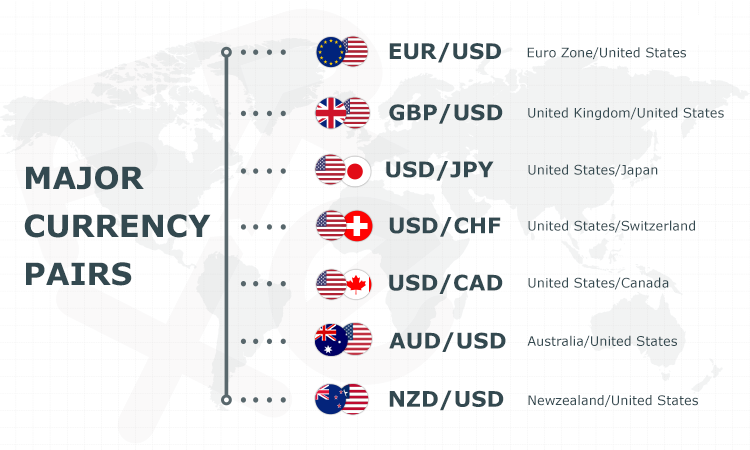

USD/JPY update:

Japan’s Government Pension Investment Fund (GPIF) is the largest pool of retirement savings in the world. GPIF manages and invests the Reserve Funds of the Japanese Government’s Pension Plans entrusted by the Minister of Health, Labour and Welfare.

The fund is likely to report a second consecutive gain of around 5.6%, mainly thanks to the weak yen boosting the value of its foreign holdings.

Yen has tumbled sharply:

The US dollar is broadly soft today but the euro and pound are particularly strong. I’m a bit wary of price action this late in the month and without a clear catalyst. German yields have risen 9.5 bps today compared to 5.7 bps in the US so there’s some spread support but that’s thin pickings.

Europe continues to face down a potential disaster with Russia natural gas imports severely curbed and a portion of US LNG exports offline.

The relief valve for last week’s frenzied trading was the Bank of Japan decision on Friday. It was a week where it felt like anything was possible after the Fed 75 bps hike and the surprise 50 bps from the Swiss National Bank.

But Kuroda and the BOJ kept their hand steady, leaving policy unchanged. The yen had rallied more than 200 pips on nerves ahead of the decision but gave it all back afterwards. That momentum is continuing today as all major global currencies make gains against the yen as Tokyo begins the trading week. Risk sentiment is also positive with S&P 500 futures up 25 points.

With that, USD/JPY is up 32 pips to 135.27. That puts it within striking distance of last Tuesday’s 24-year high of 135.60. If that level gives way it will accelerate yen selling and we could see a rapid squeeze higher as we chew into that late-90s top of 147.63.