As we turn to UK/EU trade moves in FX markets been a rather quiet affair despite the EU Summit having given us little to work with.

I have no firm intel on when we get full confirmation and the outcome but we’re now heading into the fourth day of the marathon talks, but at this point it appears we’re getting closer to a deal, with the level of grants the key sticking point and rumoured to be around E390b.

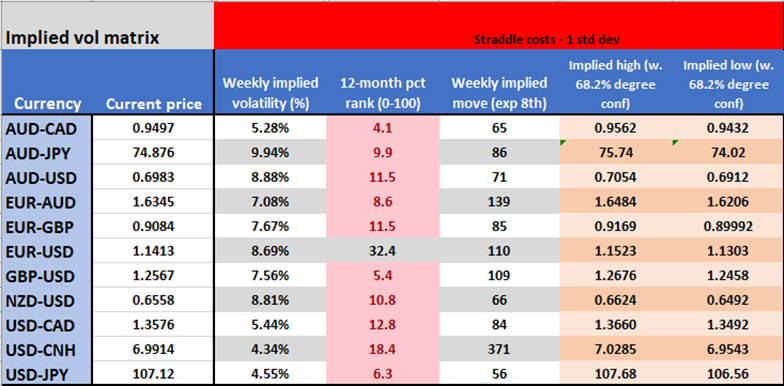

EUR implied volatility (vol) has been rising of late, as we can see this in the weekly implied volatility scan, with EURUSD 1-week vol pushing into the 32nd percentile of the 12-month range.

This puts EURUSD in an expected range this week of 1.1523 to 1.1303, with a 68% level of confidence. Once again last weeks implied move/range offered a solid guide for mean reversion traders, or those just looking to manage risk more effectively.

(Weekly vol matrix – snapshot from Friday’s close)

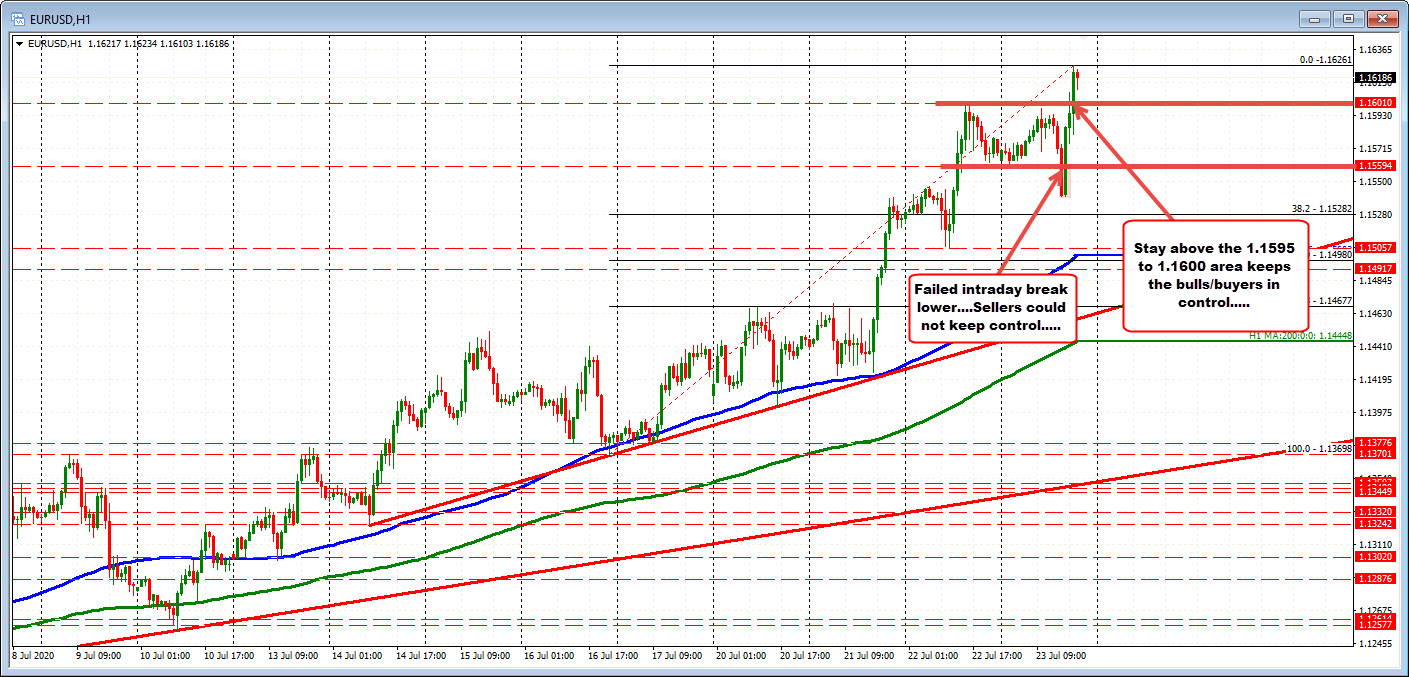

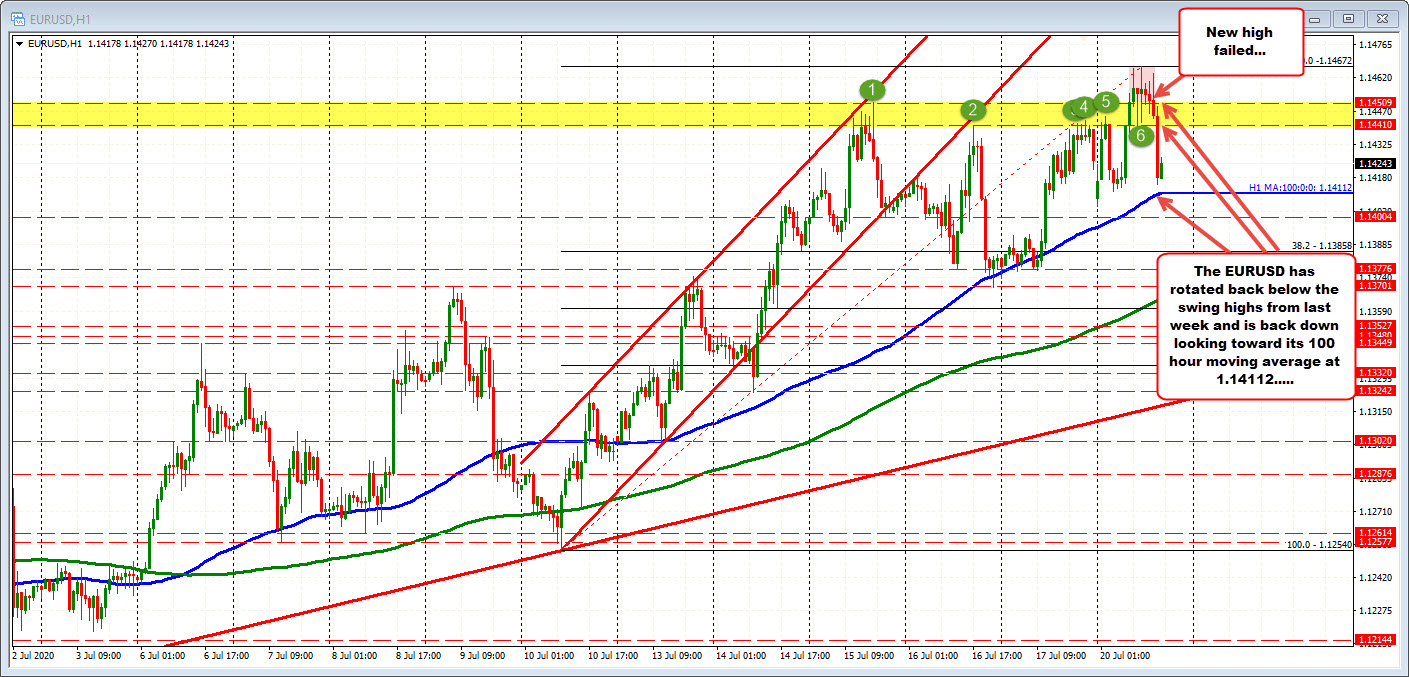

Traders were net buyers of the single currency on Friday into the EU Council meeting, with EURUSD testing 1.1447 – a level I’ve marked as core to markets – a weekly close through here could hold huge implications for global markets and take the USDX through 95.78.

EURGBP is also getting some good interest, with price having pushed into 0.9134 before finding good supply – I have this on this cross on the radar as the buyers are back in control here and we have Fridays high in our sights. A break of 0.134 would be clearly bullish.

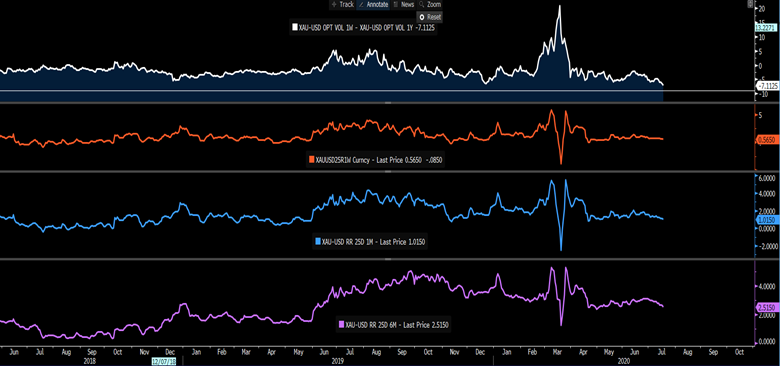

Options traders extremely neutral on gold moves

Gold is on the radar too, with the USD firmly at the centre of the thought-process today.

Moves today should be sanguine, and if I look at the options markets I see 1-week implied volatility falling to a 7 vol discount to 1-year vol – the lowest since 2013 – showing a belief that near-term moves in gold will be incredibly subdued and a grind. I also see 1-week risk reversals at 0.56, and 1-month risk reversals at 1.015 – effectively, the options markets is about as neutral on the metal as I have seen in some time – a move through 1813, and into new cycle highs, possibly changes that dynamic and see traders looking for a more explosive move in price.

Still upbeat on equities but fiscal debates offer new challenges

On the index side, the weekly chart of US500 looks constructive, and despite earnings season ramping up this week, the feel the technical side is suggestive of further upside. The risk for the market this week is on the fiscal side and equities could be sensitive to the news flow and one suspects it will not be smooth sailing.

Staying in the vol space and we see equity vol headed lower, with the cash VIX -2.3 vols on Friday and into 25.68% – closing below its 200-day MA, which is something it failed to do throughout the various tests in June. Our VIX index tracks the VIX futures and is approaching the June lows – one to watch as lower equity vol is saying we’re moving into the US summer doldrums and is having an effect in FX markets. (more…)