Battle near the lows as buyers and sellers more balanced at the levels

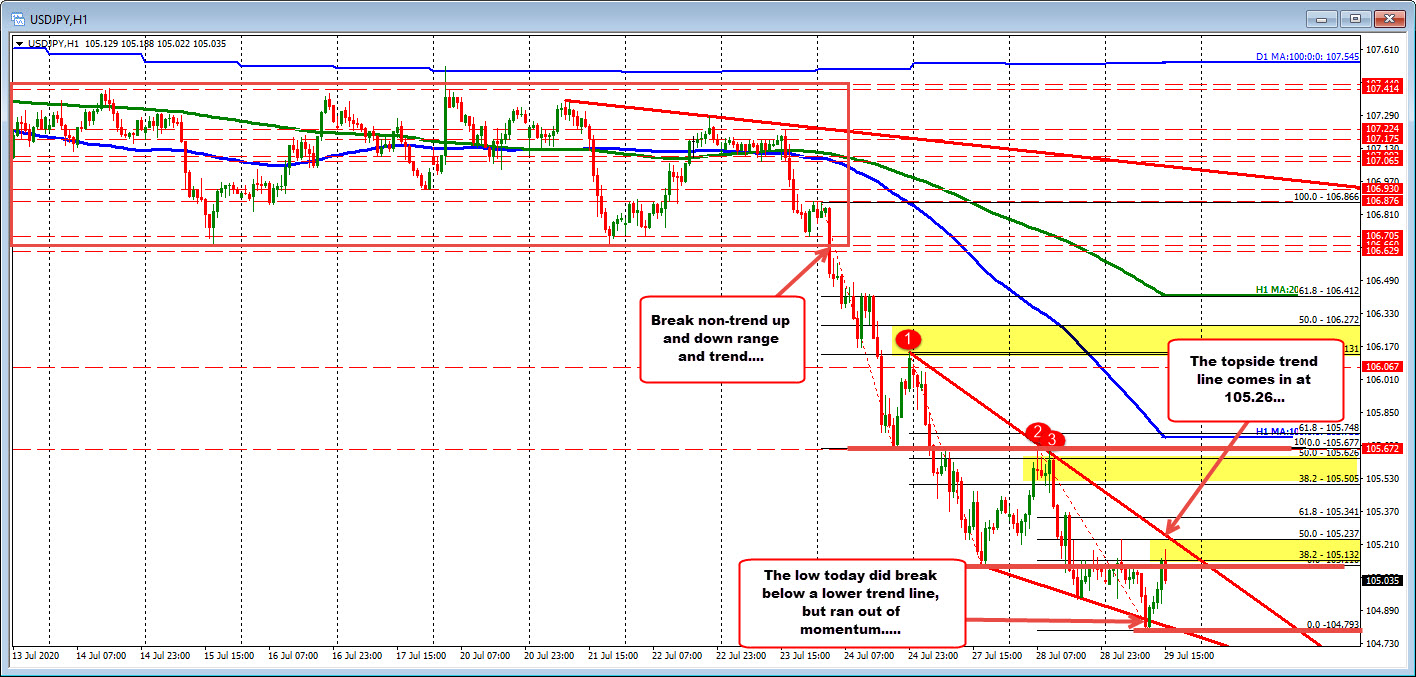

The USDJPY transitioned from non-trend to trend on Friday – breaking below the swing lows at the 106.65 area. The pair has trended lower with the price moving down to a low of 104.793 earlier today. Looking at the hourly chart, that low was able to get below a lower trendline, but momentum stalled and the price has rebounded back up toward the closing level from yesterday and the highs for today.

The inability to extend lower and a declining momentum, gives dip buyers some hope. However, the pair still needs to get above the 38.2 to 50% retracement of the most recent trend leg lower in the 105.13 to 105.237 area (see lower yellow area in the chart above).

The pair has been stepping down with 3 separate trend legs on the way down since breaking lower on Friday.

The 1st move lower corrected toward the 38.2% retracement (see higher yellow area) and resumed the trend lower.

The 2nd leg down found sellers near the 50% retracement (at 105.626) and the low from Friday at 105.677 and resumed the trend lower (see middle yellow area).

The last leg down has the “correction zone” of the 38.2-50% between 105.132 and 105.237. The high price has stalled between those 2 levels so far today.

Getting above the 50% of the last trend leg lower, is the minimum requirement (and staying above) if the buyers are to try to take more control. The downward sloping trendline is moving toward that level as well and would need to be broken (and stay broken).

Failure to break above those levels, keeps the sellers in control. Putting it another way, the buyers are not taking control. The buyers have to prove that they can start to break the back of the trend sellers They did show up near the low trend line today, but they have more to prove if there is to be more upside probing from these levels.