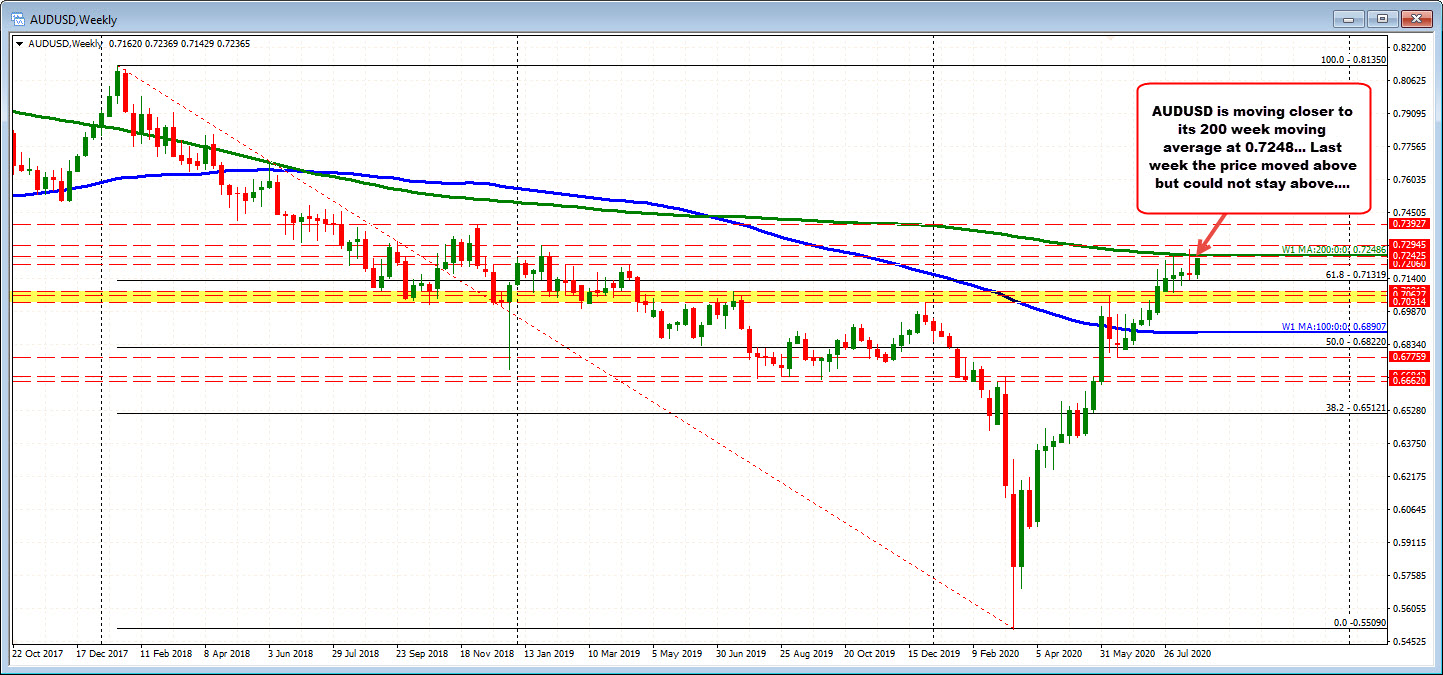

200 week moving average currently at 0.72486

The AUDUSD is trading at new session highs up at 0.72378. That takes the price within about 11 pips of its 200 week moving average at 0.72486. Last week, the price moved above its 200 week moving average for the 1st time since April 2018, but could not sustain momentum. The high price moved to 0.72748 before failing and rotating back lower.

A move above should solicit more buying interest. A close above the level at the end of the week would be more bullish. Stay below could be indicative of a top/temporary top.

Key test for both the buyers and the sellers.

.jpg)