Cable is lingering at session lows just below 1.2800 currently

GBP/USD is down to a session low of 1.2785 as the pound is struggling to for respite amid the ongoing Brexit uncertainty seen throughout the week.

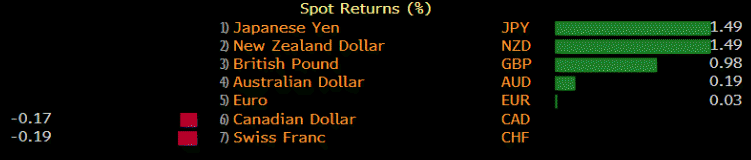

The pair is sitting lower despite the fact that the dollar is seen weaker for the most part against other major currencies, barring the Japanese yen.

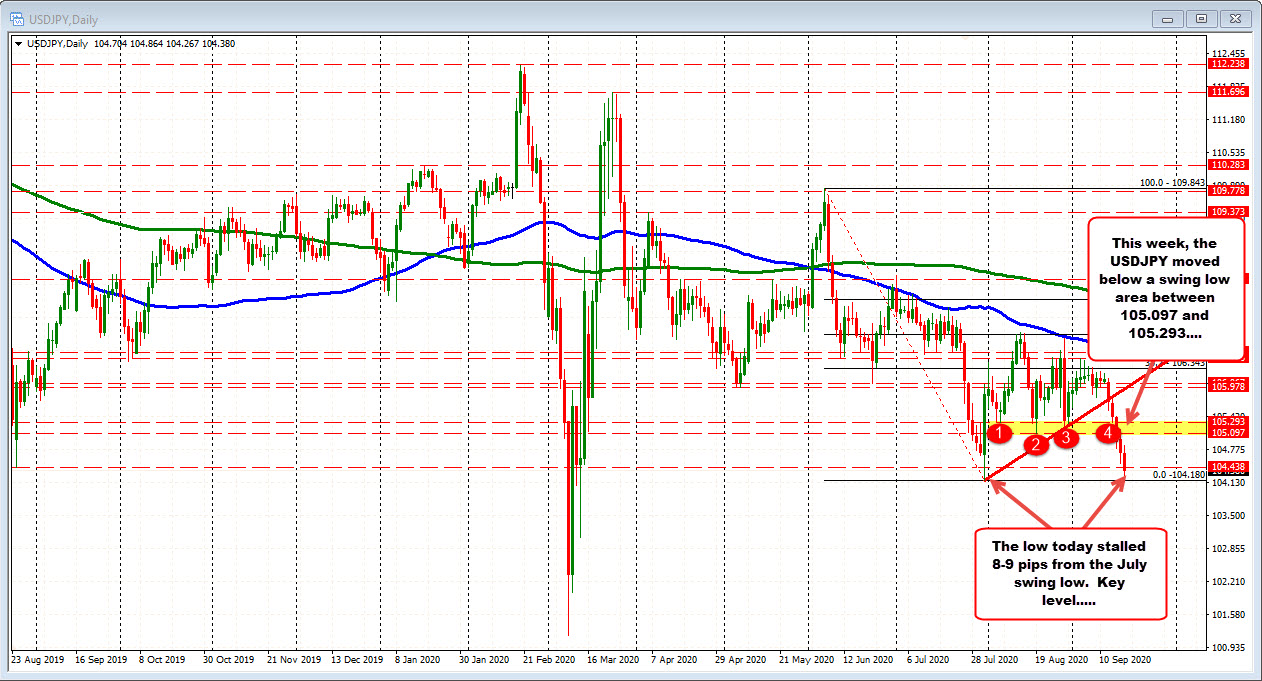

For cable, key support levels are continuing to give way and things aren’t looking pretty:

The drop yesterday took out the 50.0 retracement level @ 1.2867 and that is shifting the downside focus towards the 200-day MA (blue line) @ 1.2737 currently.

That alongside the 100-day MA (red line) @ 1.2694 (and 61.8 retracement level @ 1.2722) will be the key focus areas in case the downside momentum extends. A break below that will see sellers build even more pressure in search for a move towards 1.2500 next.

On the week, the pound has been the runaway underperformer as it is down by 3.7% against the dollar. The next weakest currency has been the Canadian dollar, which has been weighed down by slumping oil prices, and the loonie is “only” down 0.9%.