Archives of “Forex” category

rssFT says 2nd wave means Europe’s economy is sliding towards a double-dip recession … what it means for EUR

Via the Financial Times a key risk for a continued euro rally, a double-dip recession brought on by the 2nd wave of COVID-19 infections gaining pace across the continent.

Germany, France, UK, Italy, Spain, Netherlands have all brought in new restrictions to counter the 2nd wave growth

- Further restrictions are expected to be announced this week.

“I can’t believe how fast the second wave has hit,” said Katharina Utermöhl, senior economist at Allianz. “We now see growth turning negative in several countries in the fourth quarter — another recession is absolutely possible.”

FT link. (may be gated)

Europe is already looking worse on economic data indications, positioning is also a weight on EUR/USD.

Forex Update : US Dollar Index ,Euro Index ,USDJPY ,EURUSD ,GBPUSD ,AUD ,INR -#AnirudhSethi

To read more enter password and Unlock more engaging content

CFTC Commitments of Traders: Euro longs continue to lose enthusiasm

Weekly FX positioning data for the week ending October 13, 2020:

- EUR long 168K vs 174K long last week. Longs trimmed by 6K

- GBP short 10K vs 11K short last week. Shorts trimmed by 1K

- JPY long 20K vs 21K long last week. Longs trimmed by 1K

- CHF long 12K vs 13K long last week. Longs trimmed by 1K

- AUD long 4K vs 11K long last week. Longs decreased by 7K

- NZD long 6K vs 5K long last week. Longs increased by 1K

- CAD short 14k vs 18K short last week. Shorts trimmed by 4K

- Prior report

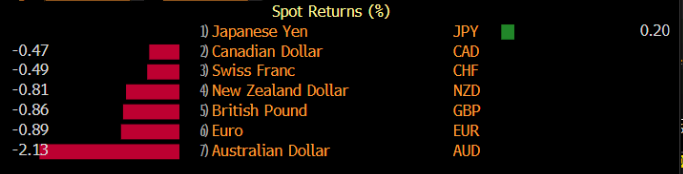

AUD/JPY shorts were the best trade this week

RBA cut talk and risk aversion dominated

The RBA offered its clearest indication yet that a rate cut is coming on the same day as the US election. That was one of the factors that weighed on the Australian dollar this week as it badly trailed its G10 counterparts.

The yen was on the flip side as risk aversion crept in.

Looking at AUD/JPY, it fell every day this week but found some bids under 74.50 yesterday and today. Technicians will be watching 74.00 in the week ahead. It’s a great spot to manage risk for anyone trying to buy the latest dip.

Offshore yuan (CNH) is trading lower after the PBOC weekend rate move

In that post you’ll see commentary that the move will impact, at the margin, to weigh on the yuan. In response, offshore yuan has indeed seen the currency weaken (i.e USD/CNH higher). Early trade:

Its worthwhile checking out a longer time frame chart for the bigger picture context – the move weaker for CNH is small in larger timeframes.

Forex Update : US Dollar Index ,EURUSD ,USDGBP ,USDJPY ,USDINR ,YUAN -Anirudh Sethi

To read more enter password and Unlock more engaging content

PBOC has lowered the reserve requirements on some forward yuan FX trading. Intervention on yuan strength?

The People’s Bank of China has cut the requirement to zero for some forward FX.

When a financial institution sells USD against yuan to clients some of these deals will be cut to a 0% reserve requirement, from 20% previously

- Takes effect Monday

CNY hit a 17 month high on Friday. This policy move from the PBOC will, at the margin, impact to weaken the yuan (a small impact only). Thee is some concern the currency will continue to strengthen into the US election so the Bank move can be read as a (small) expression of concern at the level of the yuan.

.jpg)

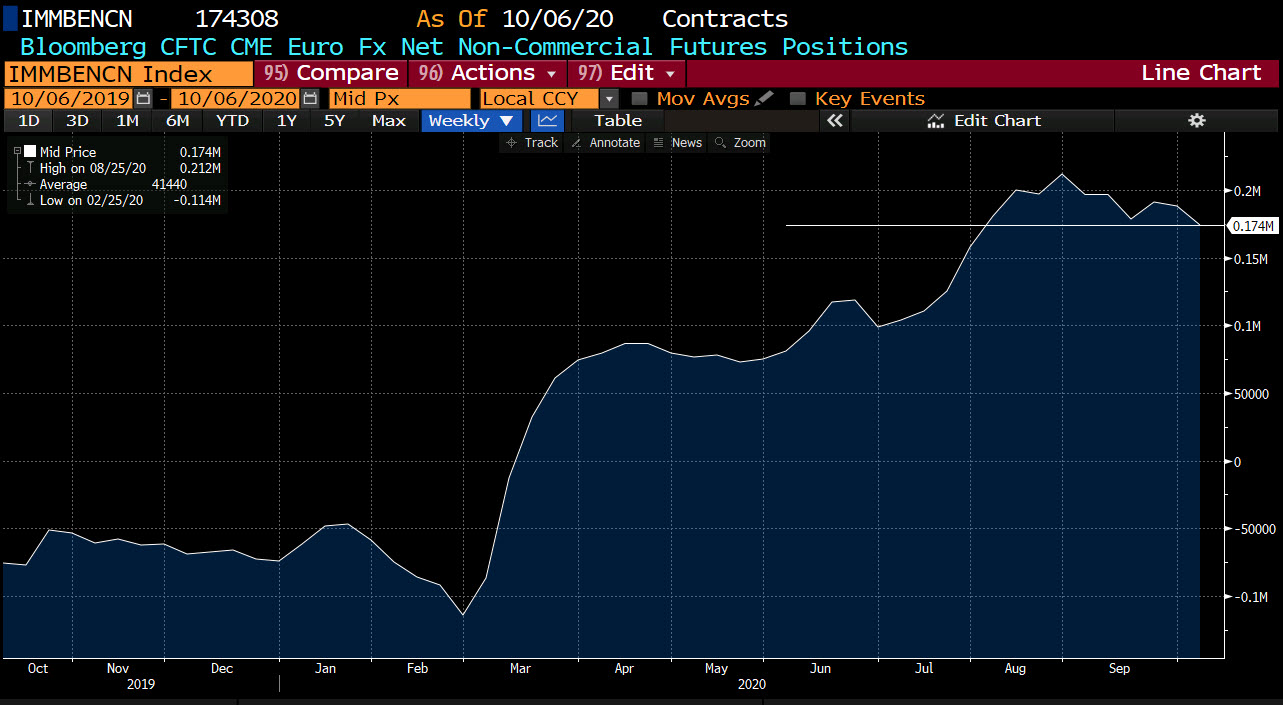

CFTC commitments of traders: EUR longs lowest since end of July

CFTC commitments of traders data for the week ending October 5, 2020

- EUR long 174K vs 188K long last week. Longs trimmed by 14K

- GBP short 11K vs 13k long last week. Shorts trimmed by 2K

- JPY long 21K vs 25K long last week. Longs trimmed by 4K

- CHF long 13K vs 13K long last week. Positioned unchanged

- AUD long 11K vs 9K long last week. Longs increased by 2K

- NZD long 5K vs 3K long last week. Longs increased by 2K

- CAD short 18k vs 19K short last week. Shorts trimmed by 1K

- prior report

Having said that, the position remains the largest speculative position of the major currencies by far. The JPY is the next highest at 21K long. The largest short position remains the CAD at -18K.

Moment of truth for $DXY. Approaching MA50 support.