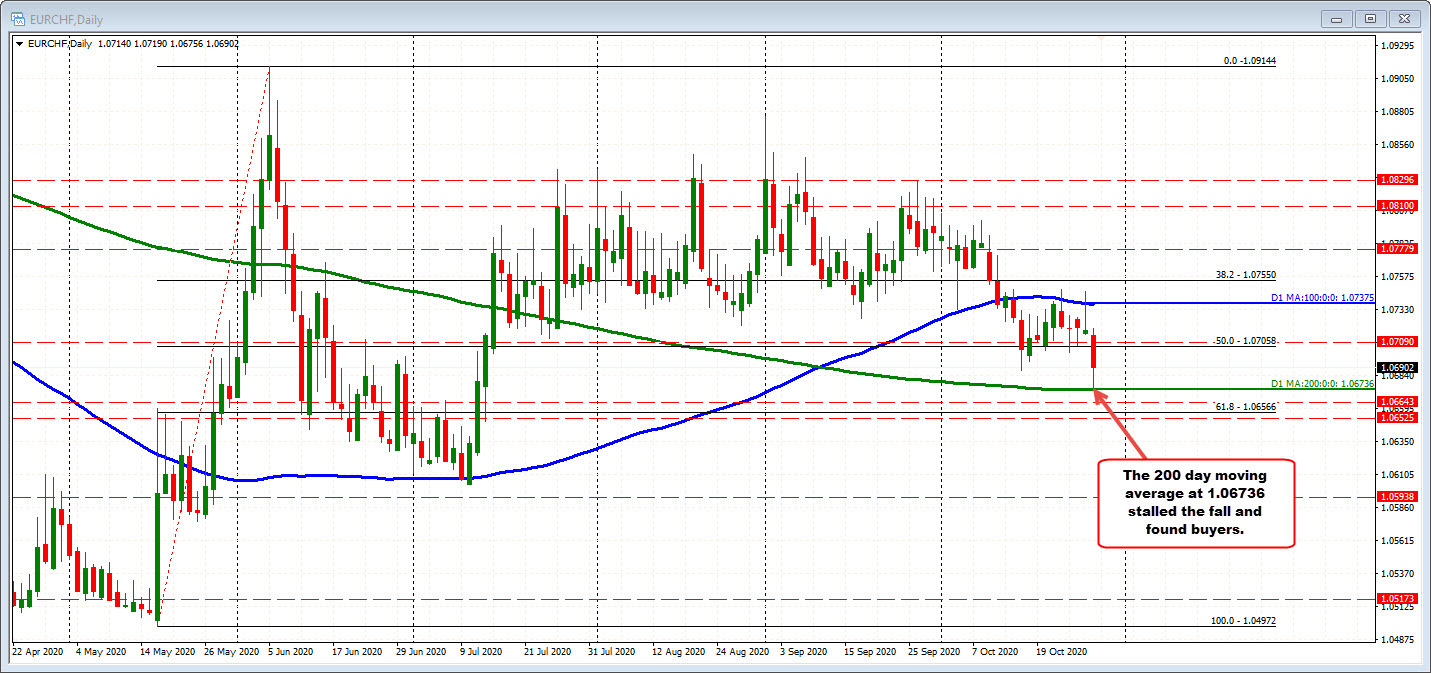

200 day MA at 1.06736 stalls the fall.

The EURCHF stumbled lower on the overall EUR selling and in the process moved to the lowest level since July 14. The low price reached 1.06756. That was just above the 200 day moving average at 1.06736.

Buyers lean against the moving average level and have pushed the price back up toward the 1.0700 level. The current price is trading at 1.0690.

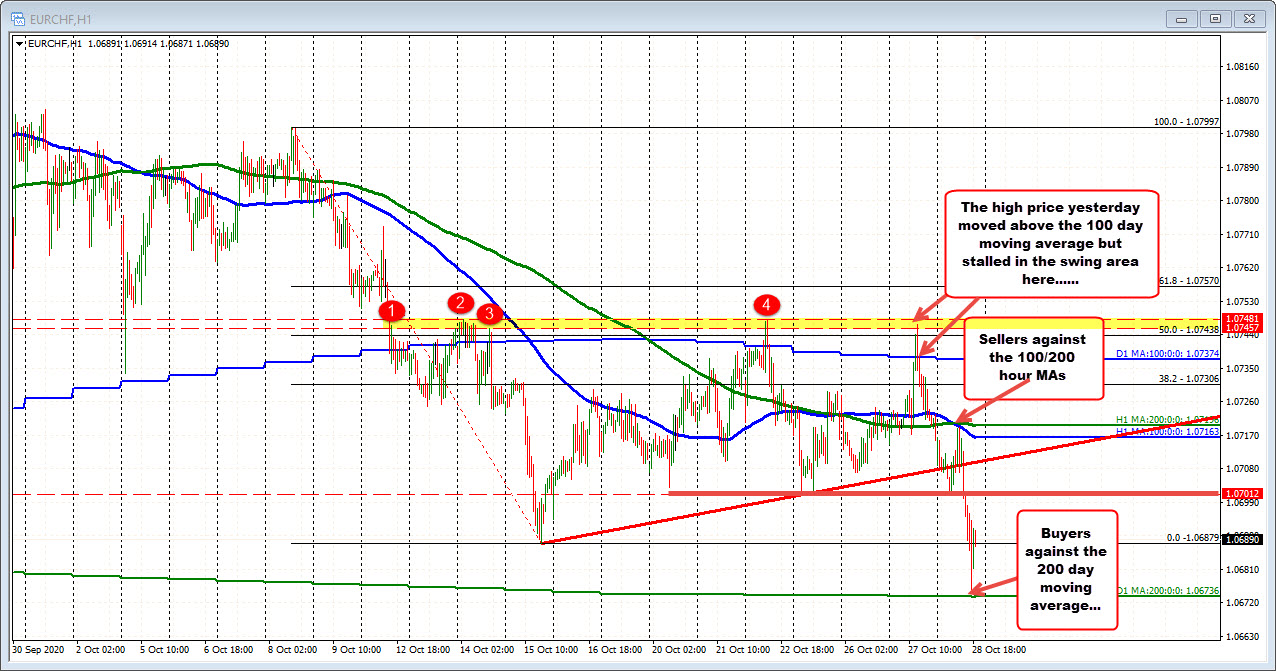

Drilling to the hourly chart below, the price yesterday moved above its 100 day moving average at 1.07373, but stalled near a swing area between 1.07457 and 1.07481 (see red numbered circles).

The move back below the 100 day moving average, turned buyers to sellers. The price settled near the 100 and 200 hour moving averages near the end of day.

Today, after a initial moved to the downside in the Asian session, the price corrected up to retest the 100 and 200 hour moving averages. Sellers leaned against level and push the price back down in the European session. The run made to just short of the 200 day moving average.

So buyers leaned at support and that supported so far held. If the price is to head back higher, reward the dip buyers, and tilt the bias more to the upside getting back above the low from last Friday near the 1.0701 level, and the earlier swing low today would be eyed. Failure to get above that level and the sellers may make another run toward its 200 day moving average.